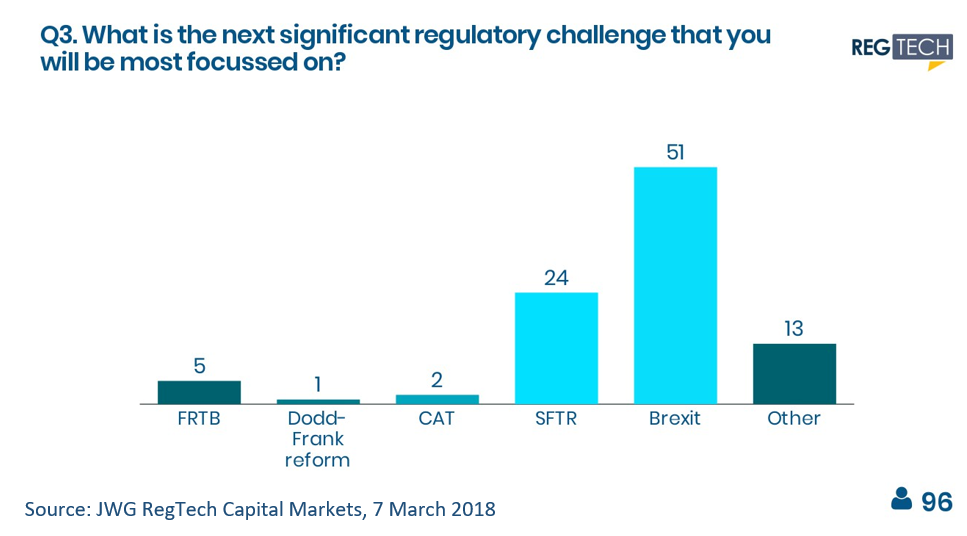

One of the key conclusions reached at our Capital Markets conference on 7 March was that regulatory divergence as a potential consequence of Brexit is currently one of the main worries for financial firms. When polled, 53% of our audience indicated that Brexit will be their next significant regulatory challenge. This anxiety derives mainly from fears of a ‘cliff-edge’ Brexit in which case the UK could significantly diverge from EU financial regulation upon exit. Such divergence would potentially threaten the UK’s access to European financial markets, thereby offsetting the benefits of any competitive regulatory advantage that the UK may gain, and this should be a key consideration for the UK government when deciding how far, if at all, the UK will deviate from alignment with the EU.

Whilst we won’t entirely know how these issues will manifest until the transition period comes to an end in January 2021, it is worth assessing the potential impact that regulatory divergence could have on both the UK’s and the EU’s financial services industries.

Whatever the impact may be, the City of London is a key consideration for Brexit negotiators on both sides of the Channel. The UK has a relatively strong comparative advantage in financial services and currently holds a large trade surplus in the sector. Roughly six trillion euros (£5.3 trillion), or 37%, of Europe’s financial assets are managed in London, twice as much as that of Paris. London is also the biggest player in Europe’s 5.2 trillion euro investment banking industry.[1] However, this situation has arisen whilst the City has had access to EU financial markets, and there is the possibility that London could lose its position of strength unless it continues to abide by EU rules once outside of the EU.

What could regulatory divergence look like?

Some eurosceptics argue that its deep and liquid capital markets, its sophisticated legal regime, and its historic trading ties could give the City of London a formidable competitive regulatory advantage once Britain leaves the EU. Others, however, argue that any regulatory divergence from the EU could be a disaster for the UK’s financial services industry.

There are some areas where the UK could gain a competitive regulatory advantage should it choose to rescind EU rules that it considers to be either restrictive or damaging. For example, the UK may choose to adopt lower capital requirements for financial institutions than the relatively high and restrictive requirements currently imposed under EU regulation. However, the UK will have to weigh-up whether the reductions in regulatory costs resulting from divergence outweigh the potential loss of access to EU financial markets.

One issue that could hinder the UK’s ambition of gaining a competitive regulatory advantage outside of the single financial services market is the EU’s treatment of ‘third countries’, which is what the UK would become when it leaves the EU.

The EU insists that countries outside of the EU who wish to have access to EU markets must maintain regulatory equivalence when it comes to financial services.[2] Throughout the Brexit negotiations thus far, the UK government has applied strong pressure on the European Commission to water down its proposals for testing equivalence of regulation, and, as a result, future directives relating to regulatory divergence will most likely no longer enforce strict equivalence for third countries. Instead, ESMA will test whether regulations for third countries are ‘likely to be equivalent’.[3]

Moreover, regulatory divergence can be costly. A recent survey carried out by the IFAC and OECD estimates that regulatory divergence costs the global economy $780 billion each year.[4] As such, the UK may wish to remain as closely aligned to the EU as possible when it comes to financial regulation.

Euro-denominated trading

There is one area where we can be more certain about the consequences of Brexit for financial services, namly Euro-denominated trading. The ECB dictates that ‘key technical facilities’ and information systems of clearing houses with a large proportion of euro-denominated business must be located within the eurozone. The ECB’s location policy gives it authority to deal with ‘off-shore’ centres, as the City would become in the event of Britain’s exit. As a result, the ECB would most likely force clearing houses that settle euro-denominated trades to relocate from London to within the eurozone.

The impact on the banking industry

Many European banks use the UK as a base for their centre of operations, and London has the largest concentration of foreign bank branches in the EU.[5] Many EU banks choose to set up branches in the UK, as opposed to fully capitalised subsidiaries supervised and regulated by the UK authorities, because it reduces funding costs.

Outside of the EU, the UK would still be able to allow EU banks to set up branches in the UK, provided that the City of London ensured regulatory equivalence to that of the individual EU member state. But non-EU banks would not be able to set up subsidiaries in London and use them to branch out into the EU. To maintain a presence in the EU, each non-EU bank would have to set up an additional subsidiary within an EU member-state, forcing them to comply with three regulatory regimes under MiFID II: their home country’s, the UK’s (as a condition for setting up a subsidiary in London), and that of the EU member state in which they established the subsidiary.

This could have a significant impact on the number of banks who decide to operate in the UK after Brexit. To avoid such regulatory costs, many banks may decide to relocate from London to other European financial centres such as Paris or Frankfurt. According to the think-tank Bruegel, London could lose up to 10,000 banking jobs and 20,000 roles in wider financial services as firms begin to move 1.8 trillion euros of assets outside of the UK as a result of Brexit.[6]

Business as usual then?

Ultimately, the City of London is an integral part of the EU’s financial sector and banking union, and it is fair to say that London’s financial prominence would not immediately collapse upon exit. ‘Its central role in foreign exchange and securities trading, in insurance and asset management, and in financial law and accountancy services would continue, as would its position as the location of choice for many leading private equity and hedge funds’.[7]

However, if the City wants to continue its access to EU markets after Brexit then it will have to compromise by constantly updating its regulations so as to ensure alignment with the EU. This would limit the possibilities for any regulatory sovereignty that the UK plans on gaining upon exit, as any regulatory competitiveness achieved would come at the expense of losing access to EU markets.

In any case, it looks likely that the bonfire of red tape being advocated by some Brexiteers may not materialise. The UK government has helped shape the rather stringent approach to financial regulation since the financial crisis, and this hawkish stance would most likely continue upon Britain’s exit through fear of undermining the stability of the UK’s financial markets.

[1] https://www.relocatemagazine.com/articles/brexit-what-lies-ahead-for-the-uks-financial-services-mcurphey-spr18

[2] KPMG, ‘Provision of services by financial intermediaries from third countries in EU financial markets regulation’, 2011.

[3] http://www.cer.eu/sites/default/files/publications/attachments/pdf/2014/pb_city_brexit_js_pw_8may14-8816.pdf

[4] https://financialregnews.com/survey-examines-impact-regulatory-divergence/

[5] http://www.cer.eu/sites/default/files/publications/attachments/pdf/2014/pb_city_brexit_js_pw_8may14-8816.pdf

[6] http://bruegel.org/wp-content/uploads/2017/02/PC-04-2017-finance-090217-final.pdf

[7] http://www.cer.eu/sites/default/files/publications/attachments/pdf/2014/pb_city_brexit_js_pw_8may14-8816.pdf