FS Compliance officers have been hit with an unprecedented deluge of 3,021 COVID-19 alerts 2 months into the pandemic, which JWG forecasts to be a total of 15,695 documents by year end.

Regulators expect firms to be able to navigate these difficult circumstances while delivering fair outcomes for customers and complying with existing rules. That’s one of the clear messages in these 3,000 plus regulatory updates.

Better RegTech tooling is needed urgently to avoid costly fines and embarrassing post-COVID audits. Change managers already struggling with a full book of work have to date seen 98% of 2019 document volumes, while attempting to keep up with skyrocketing business volumes while working from home.

COVID work levels

JWG has undertaken a meticulous review of regulatory publications relevant to financial services captured up to 15 May in our RegDelta system across 47 jurisdictions which are relevant to financial services institutions.

In examining the data 2 months after the WHO declaration of a new pandemic on 13 March we find:

- Overall noise levels for compliance have more than doubled with 6,346 documents captured already this year representing 98% of the total 2019 document count

- 3,021 COVID documents represent 48% of the total 2020 volume to date and we forecast 8,496 by year end – 31% more than all documents published last year

- By year–end our conservative forecast is 15,695 total COVID and non–COVID documents – 143% over 2019.

These overlapping requests are from conduct regulators, prudential regulators, market operators, international bodies, and of course state, federal and regional government. JWG has found over 100 cross-sector sources like justice ministries and public health sites are now required to be part of daily horizon scanning procedures.

COVID documents are not large. The average is 3 pages long, a press release (45% of 55 document types) and linked to several other information sources. On average, there are 68 COVID documents a day with the highest publishing jurisdictions being: The United States, Belgium, EU, UK and Australia.

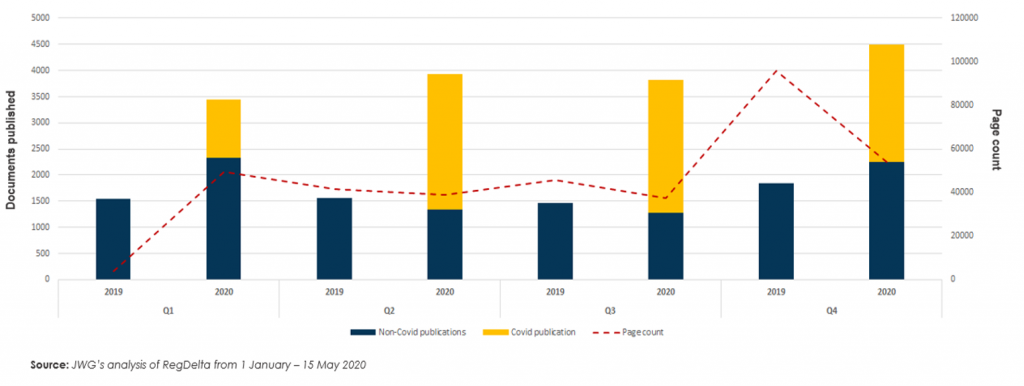

As illustrated in the chart below, thanks in large part to a new European Commission springing into action while Brexit plans were underway in Q1, the overall document publication volumes are up 122% from 2019. We predict that this will increase for the next 2 quarters with volumes in excess of 150% per quarter before easing off slightly in Q4 to a mere 143%. This represents an unprecedented risk for already overworked and under–resourced compliance officers and SMEs who face the additional challenge of keeping up with market volatility.

Exhibit 1: 2019-2020 global FS policy document forecast

Swamping the Pre-COVID book of work

The rules of finance have been built over decades, not days and the art form of interpreting a financial institution’s polices require a lot of reading, socialising and human intelligence.

This decade brought with it the most comprehensive set of reforms to date with Europe, UK, US and other jurisdictions shifting focus across the globe. The discussions will affect market structure & conduct, risk management & governance and controls.

New policy initiatives like ESG, Operational resilience, Data and AI have started to ramp up as MiFID III, MAR II, EMIR Refit, SFTR, AMLDV and Culture are being revised. Compliance is going ever deeper into challenging questions about how the infrastructure works, where the data goes and how one can prove that the last decade of new obligations are beginning to be met.

This means that when Compliance is hit with nearly a years’ worth of documentation in the first third of the year, an interconnected patchwork of critical dependencies needs to be prioritised quickly and tied back to current plans by many busy professionals.

Global policies which are set at a high level, need to be cascaded down to businesses that then apply the local laws. To take just one example, for the front office the updates affect how a business trades (e.g., short selling, disorderly markets), where it trades (e.g., from home), the supervision of the trade (i.e., surveillance policies) and what must be communicated to the client (e.g., NAV, best execution reporting). Of course, these and other updates will also affect the middle and back office like AML procedures, risk management and SM&CR controls.

Focusing on just a Market Abuse policy, an analysis from early May revealed that 32 documents related to detection of market abuse, 9 on public disclosure of inside information, 12 on insider dealing and 6 on market manipulation of a set of 64 documents with a mere 156 paragraphs.

This detailed example gives us a sense of the interconnections, but it is only when we step back to the full dataset that we see the comprehensive impact of COVID. The word cloud in Exhibit 2 is generated from our Natural Language Processing of the regulatory topics discussed in the documentation.

Exhibit 2: 2020 COVID FS policy document themes by regulatory topic

Source: JWG’s analysis of RegDelta from 1 January – 15 May 2020

Get RegTech-ready for post-COVID audits

In our special interest groups this year, Compliance officers from 30+ firms have been conscious of how the UK FCA has repurposed the Senior Management regime (SM&CR) to co-ordinate the relationship between the regulator and firm under COVID. Firms are now wary of ‘culture audits’ – an agenda highlighted in DP 20/1.

The impact of this shift is that UK regulators will move away from evaluating strictly balance sheet measures like liquidity risk to softer risks like human risk metrics, health of the challenge function or the ability to respond to change.

Regulators are focused on senior management accountability for crisis decision making and audits loom later this year. If it is not already a subject of discussion, expect SM&CR and Culture audits to help measure the way your organisation has responded to this vast workload.

Regulators will be keen to understand how a firm came to grips with COVID’s impact and managed the associated risks. This is a real-time test of systems and controls, culture, risk management and governance all rolled into one. Are you going to pass or fail?

One easy way to get better marks is to upgrade your regulatory horizon scanning and policy management RegTech. Old world Microsoft Office tools are no longer viable in a in a fast-changing environment which breaks a human’s capacity to absorb rule changes. Tracking spreadsheets cannot be maintained and policies will no longer be able to be kept current in a SharePoint. This will make audits of what policies were in place on May 15th and how they took into account of the 2,999 relevant updates very challenging if you are not on a modern RegTech platform.

In a world of senior management accountability, missing a single update can cause a disproportional loss. To mitigate this risk financial institutions need to redefine how they coordinate their response and utilise readily available cloud-based solutions to understand where they are on the journey to having a single view of the regulatory truth throughout their organisation.

Now more than ever, a global enterprise needs an efficient tool to reassemble and configure their obligations into a single version of the business truth as JWG provides in our RegDelta system, which is the source of this analysis.

About the author: PJ is the Founder and CEO of JWG Group, a think-tank based in London which is recognised globally by regulators, financial institutions and technology firms. He is a frequent author and international public speaker on the role of new technology within the financial services infrastructure. You can contact him on pj@regrisksolutions.com.

This article was published in Thomson Reuters Regulatory Intelligence on 1 June.