JWG analysis.

As we read the comments on our last article on the five tribes of regulatory reform, we were struck by the visceral reaction to the suggestion of sharing the agenda. “Hands-off, that’s my mortgage you’re messing with“, commented one lawyer. We wonder, can tribes achieve their overarching regulatory goals if they are NOT empowered to share?

The big chief that doesn’t exist

The reality of our reform environment in 2015 is that there is no ‘big chieftain’ of all reform. We have prudential regulators asking for new risk management, market regulators fundamentally changing the way the market works, financial crime regulators asking us to conduct business differently and even politicians changing the way we structure ourselves. In essence, the industry is facing off to many regulatory requirements that don’t fit perfectly together and it’s up to the 5 tribes to sort out the details. But in this environment, it is impossible for one leader to unite the tribes and take on the entirety of reform from any camp: regulator, firm or supplier.

Getting thousands of people from different backgrounds to think alike is no small ask, and not one to be attempted by one tribe alone. The business, legal, change and operations, data and IT tribes all need to contribute their individual points of view into the joined-up perspective on the ‘so what’ of each regulatory requirement.

The case for sharing

The biggest imperative for the board this year ought to be getting all the tribes on the same page. Have you ever tried to read a stack of paper as high as the Eiffel Tower? Do you really think you can hire one tribe to read it all for you and assess the end-to-end impact? It would be far better, faster and cheaper to get your comrades sharing knowledge about the requirements and defining the ‘so whats’ within and across tribes. Yes … sharing with the tribe next door might be unnatural for financial services, but isn’t that what the regulators are asking? Take, for example, when earlier this month, Thomas Baxter, Executive Vice President and General Counsel of the Federal Reserve Bank of New York, offered some thoughts about compliance at a symposium.

“The function has morphed, ‘as compliance programs developed … companies found that the compliance officer turned into the chief compliance officer, because in major companies, it took a village to get compliance done. Compliance, you see, turned from singular to plural.”

Working in parallel

We couldn’t agree more. A village is required to track legal risk, operational risk, vendor risk, cyber risk, et al, and we begin to wonder how this industry can continue to do business with that many people watching those that are attempting to make money.

Another regulator’s view on managing the road ahead from last quarter:

“We need leadership from top. … The business model must be simple enough that it can be shared with employees and understood at every level. … Within the category of operations, I envision the development of industry standards on culture and behavior, enhanced communications, both within firms and across the industry, and clarification around success metrics.” Sarah Dahlgren, Executive Vice President of the Financial Institution Supervision Group of the Federal Reserve Bank of New York, 25 October 2014

Taken together, these regulators point us towards running the ‘what’ conversations in parallel with, not subsequent to, the questions of ‘how’ to change the bank to meet regulatory demands.

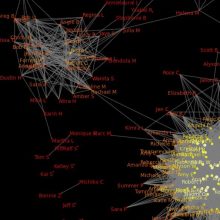

The virtual village – a single platform for all needs

Tribes will need to interpret meanings in different dialects and in different timeframes but they ultimately all need to share. To do this, they need better tools. Think about it. How do you expect all the tribes to troll through their inboxes, regulatory websites and shared drives to find the text that came out yesterday – and still all remain on the same page? Without a library that covers regulators and output from your tribes, how are you going to record and socialise analysis of the impacts? Will PowerPoint or a spreadsheet really cut it? Who is going to know the right person to ask if they are not identified next to the paragraph that they own?

The good news is that these platforms now exist. Organisations can license platforms like RegDelta to track, assign, report, monitor change and facilitate business impact analysis of the many millions of pages of regulation that they are obligated to comply with all over the world. What’s more, they can now go ‘straight through’ from regulatory text to their organisations, policies, processes and systems to make sure the villages are safely compliant.

Of course, tribes will focus on different portions of the text, but they can all work from the same library and, therefore crucially, together. The legal and business tribes will assess the critical issues of how your business activity falls within the perimeter of the rules, given your legal structures, products and customers. The operational and control tribes will focus on issues of ‘how’ and when (e.g., what is it going to take to monitor and control the new information flows to counterparties, regulators and the market?).

When presenting to your tribal chiefs, each theme can be tagged up and made relevant to them. If they focus on policies – run an impact assessment report on the policy you chose. If you are a data modeller – map to the logical data model. You get the idea but, if you don’t, give us a call and we’ll show you how it is done.

As we have seen from the past year of using this in our special interest groups, the beauty of having it all on one platform is that it allows the tribes to clear their assumptions about what ‘good’ looks like, the standard approaches to getting there and when the herd is moving.

Are you in a 1 tribe firm?

Ask yourself, can I afford to be in a 1-tribe firm? A 1-tribe firm decides that compliance is going to buy a licence to a new service – but nobody else gets access. A 1-tribe firm finds a way to buy a bit of generic commentary on a document and the legal department positions it as ‘the answer’ for the firm. A 1-tribe firm could even delegate the change to a ‘consulting project’ and, a few months after Elvis leaves the building, nobody is really any the wiser about what they are missing.

If this sounds familiar, go do the maths for your boss. There are 5 tribes, each locking up regulation as their own 1-tribe issue but, by keeping operations, technology and data in the dark (consciously or not) they are excluding 80% of those who also need to make ‘doing business right’ part of their culture.

At the end of the day, the firm that empowers its tribes better than their competitors wins the battle. Get in touch if you’d like to join our KYC, MiFID II or reporting groups, or just see what RegDelta can do for you.