In a landmark third SteerCo meeting, industry leaders from FINOS’ Open RegTech Council, supported by industry think-tank, JWG delved into the groundbreaking results from the open-source regulatory reporting (ORR) initiative last month.

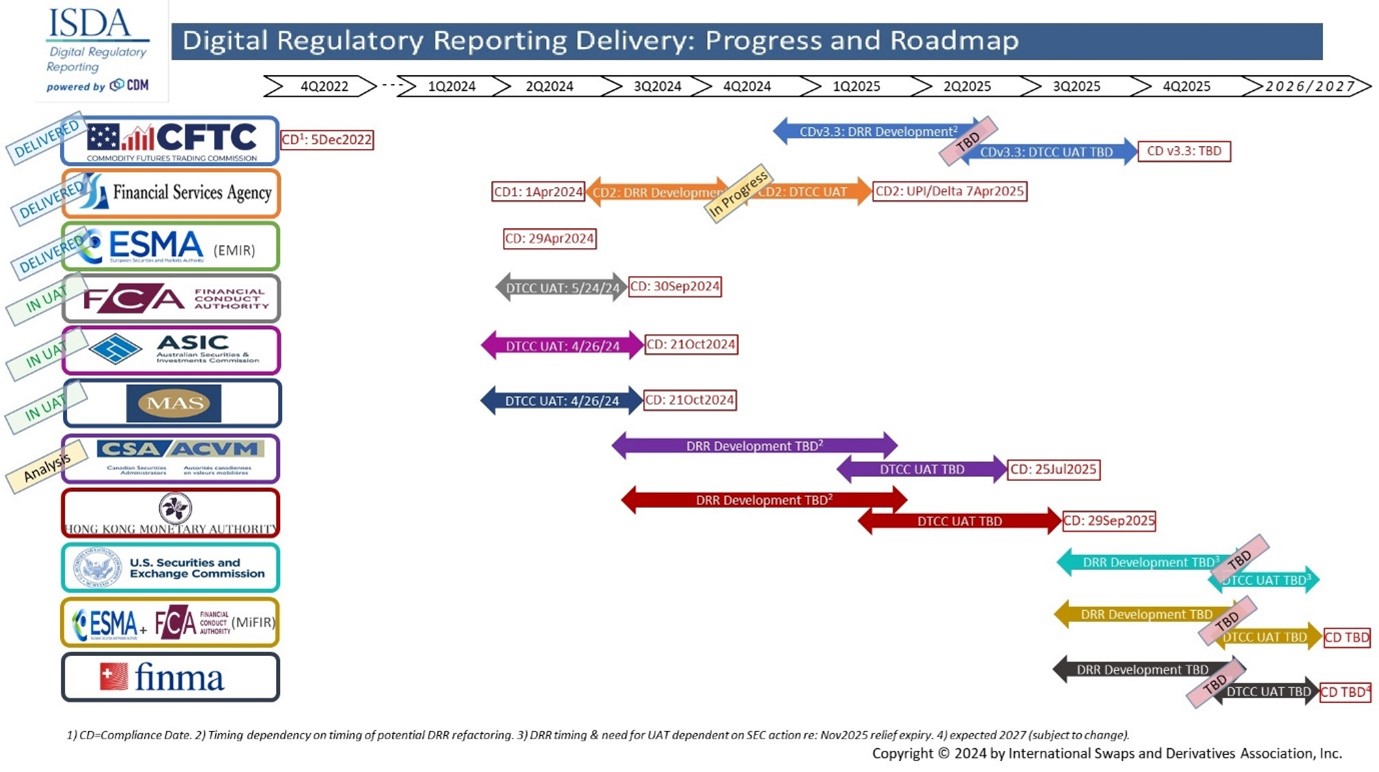

Digital Regulatory Reporting (DRR) and the Common Domain Model (CDM) are poised to revolutionize regulatory compliance and leaders are getting ahead of the pack by installing the tier-1 code to meet upcoming regulatory reporting deadlines.

Context and Goals

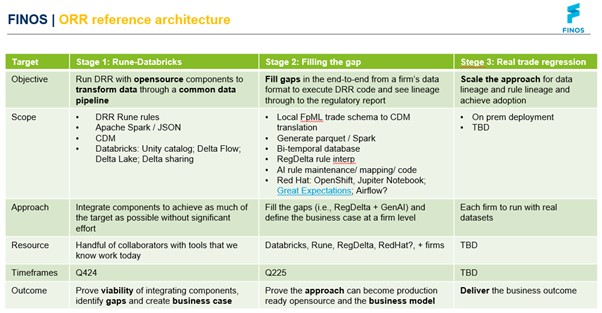

The aim of this initiative is straightforward but powerful: leverage open-source tools to transform how financial institutions manage regulatory reporting, drastically cutting costs and time. The overall goal is to move beyond legacy systems that translate rules manually and into a fully digitalized, scalable system that works in any cloud environment.

The target solution will transform rules from text into executable code, ensuring real-time auditability for institutions managing complex reporting obligations.

Jane Gavronsky, COO of FINOS said, “These contributions enhance the existing toolset available as open source to provide an end-to-end solution for regulatory reporting in the cloud.

This is a game changer and will make it easier for IT teams to conduct proofs of value to adopt a leading open source framework being championed by tier 1 financial institutions.”

Recap of Achievements So Far

In the first phase of the ORR pilot following enhancements to opensource libraries, non-technical analysts were able to install DRR and CDM models in under a day. Powered by open-source tools, the analyst successfully processed test trades and translated them into ISO 20022 reports. These were validated against trade repository (TR) data quality rules, demonstrating the system’s ability to automate compliance tasks without proprietary tech dependencies.

Importantly, the code is freely available for anyone to replicate and contribute to, lowering the barrier for entry.

Ian Sloyan, an independent consultant formerly with ISDA commented, “This achievement is a significant realization of the vision demonstrated during the UK FCA/BoE Digital Regulatory Reporting (DRR) pilot in 2019—where ISDA’s Common Domain Model (CDM) first featured—and further exemplified in the G20 Tech Sprint in 2020, which ISDA and REGnosys won. Since then, ISDA and JWG have championed this vision through the ISDA DRR project and the FINOS Open Reg Tech initiative.”

The Benefits: Open Access and Cost Efficiency

A major discussion point was the value of the ISDA-backed timeline for DRR adoption, reminding participants that this open-source approach provides a transparent, industry-vetted path.

This not only saves on internal development costs but also ensures all stakeholders have access to identical, industry-standard code. By using openly shared tools, financial firms stand to dramatically reduce time spent on regulatory compliance while improving accuracy and auditability.

Sloyan continued, “Now, with phase one of the Open Regulatory Reporting (ORR) available, even individuals with limited technical expertise can get it working. I strongly encourage firms to explore this implementation, see how intuitive the CDM and DRR are, and actively participate in shaping the upcoming phases. These tools hold the potential to revolutionize regulatory reporting by making it more streamlined and cost-effective.”

What’s Next? Stage 2 Priorities

With the successful pilot of Stage 1, the meeting turned to what’s ahead for Stage 2. The focus now shifts toward addressing end-to-end gaps and enhancing CDM’s usability. Immediate steps include leveraging GitHub to encourage broader industry feedback and refine the tools. Stage 2 aims to refine the FpML-to-CDM translation process, incorporate Generative AI (GenAI) for rule interpretation, and enhance data lineage traceability back to regulatory texts.

Collaboration at the Core

Tooling from opensource vendors like Red Hat, Databricks and REGnosys are set to collaborate further with RegDelta Link, on integration options to deliver this solution at scale. JWG’s role in Stage 2 is crucial, facilitating engagement with compliance, legal, and operations teams to refine the lineage and compliance aspects of the solution.

Driving Industry Adoption

Participants are urged to try out the current version of the PoC via FINOS’ GitHub repository: FINOS link, which offers detailed documentation to guide the installation and testing process. Feedback from users will be critical in refining the tools and driving industry-wide adoption.

Conclusion

This meeting signifies the dawn of a new era for regulatory reporting. The pilot project shows that ORR is not just a theoretical solution but a practical, cloud-native tool that can be adopted widely with minimal friction. As more firms and vendors join the initiative, the dream of a fully digital, transparent, and automated reporting system is becoming a reality.

The message is clear: Get involved. Test the tools. Provide feedback. Help shape the future of regulatory reporting.

Call to Action:

Try the FINOS GitHub here, today to test the open-source DRR solution in your environment. You can access the latest FINOS Opensource Reg Reporting SteerCo minutes and materials here.

Join a growing movement of financial institutions ready to transform how regulatory compliance is handled by contacting pj@regrisksolutions.com.