JWG analysis.

According to an article by Rachel Wolcott of Thomson Reuters, the FCA have now elucidated that they will operate a zero-tolerance policy with firms not giving their all on the approaching MiFID II deadline.

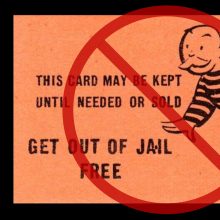

Hopes have been dashed that the sheer size and complexity of the regulation would either push back the deadline or make regulators more sympathetic. While the FCA are well aware of MiFID II’s implications for the restructuring of a firm’s operations, they are still expecting involved parties to give it their best shot and to provide justifiable reasons for non-compliance. Indeed, even though ESMA’s draft regulatory technical standards were delayed, leaving firms with an even narrower window of time to implement extensive changes, there will be no get out of jail free cards. If firms are struggling, they need to notify the competent authorities of their implementation issues to make them aware that – at least – attempts are being made.

It’s not that regulators are leaving the regulated in the dark – they are shining a light by offering this help. But firms cannot just simply hide in the corner and wait for this to blow over … if they do not come out and seek the guiding light, the regulators will find them. And they will punish them.

MiFID II has been looming on the horizon for a concerning amount of time. Its uncertainty and the lack of specifics to date are enough to give any firm a bit of frostbite but, if the regulators are offering a hand (take hold of it, or there’ll be trouble), is it time to step up a notch?

Speaking on the matter, chief executive of JWG, PJ Di Giammarino, stated that “this challenge needs senior management’s grey cells applied to it. The MiFID II blueprint has been visible for a long time and, despite the constant churn of text, we know enough to get on with most of it. Senior business, operations and IT staff need to answer the ‘so what does this mean to us’ questions for their stakeholders now. As an industry, we know the general approach we should take to make the businesses fit for purpose, but the hardest part is transitioning to the new reality while continuing to operate efficiently. It is likely to be the most disruptive change they will ever face.”

So it’s going to be a bumpy ride. The FCA’s message is very clear – no matter how far you are in your MiFID II implementation, engage with the regulators. By opening up the dialogue, firms can demonstrate what steps they are taking to meet the objectives. This will allow the regulators to make allowances where necessary if – but only if – they are approached about it first.

Unfortunately, this is not a matter that can be bluffed – if firms are to be truly transparent, they must give MiFID II their all and meet whatever is achievable in the short time available.

With this in mind, keep updated with our alerts here. And keep alert in general!