Stay on top of hot RegTech themes in JWG RegTechFS hubs

Get tailored, exclusive content and access to JWG's LinkedIn groups spanning Reporting, Surveillance, AML/KYC, Cloud, Data and more

Signup is free, fast and secure.

Regain control of global regulatory change by working with leading financial institutions, regulators, trade associations & leading vendors

JWG's mission is to help financial services regain control of global regulatory change by adopting a technology-enabled, standardised and collaborative approach.

Find out moreGet latest relevant content from our Community, Intelligence Hubs & RegCast

Latest Articles

Published: February 21, 2024

Published: January 26, 2024

Published: January 22, 2024

Latest Events

Event date: April 12, 2024 5:00 pm

Event date: March 19, 2024 6:00 pm

Event date: February 7, 2024 8:00 am

Event date: February 6, 2024 6:00 pm

Latest Special interest Groups

Event date: April 23, 2024 2:00 pm

Event date: March 15, 2024 1:30 pm

Event date: October 13, 2022 1:00 pm

Event date: June 14, 2022 1:00 pm

Latest Podcast Episodes (View All)

Aired on: January 29, 2024

Aired on: January 27, 2024

Aired on: January 23, 2024

Available on all major podcast platforms, including:

RegTech Intelligence

Your comprehensive library of in-depth articles, white papers, surveys, reports and analytics, covering ever changing regulatory obligations and how new technology ensures compliance.

Explore RegTech IntelligenceRegTech Community

RegTech Communities provide a dedicated, safe space where financial institutions, regulators, trade associations and technology suppliers come together to stay ahead of sector demands.

Explore RegTech CommunityRegDelta™ Solutions

RegDelta is JWG's enterprise-ready regulatory intelligence platform that uses AI to help your organisation scan the horizon, assess the impact and control your obligations.

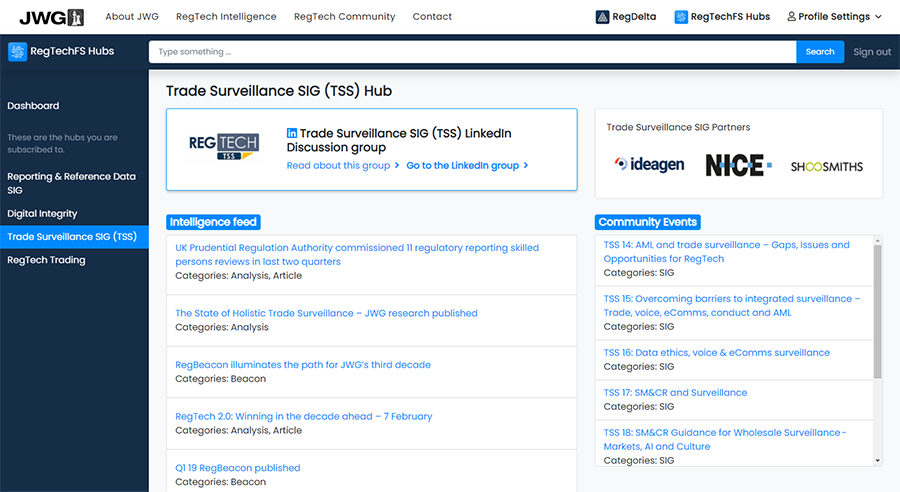

Explore RegDeltaJoin RegTechFS Hubs to get a bespoke library of intelligence.

In 2020 we digitised our collaborative platform to bring you 'safe spaces' for intelligent discussion of RegTech is being deployed across business domains.

Our ‘safe spaces’ have helped a heavily regulated industry without a prescriptive approach to solutions tackle trading, surveillance, reporting, AML/KYC, infrastructure and industry governance solutions in an independent manner.

Discover RegTechFS Hubs

Fostering Collaboration

We crowdsource globally, from the heart of London to confront new regulatory obligations early – SIGs, round tables, conferences, surveys and webinars.

Latest from RegTech Community

April 23, 2024 2:00 pm - In: Event

April 12, 2024 5:00 pm - In: Event

March 19, 2024 6:00 pm - In: Event

March 15, 2024 1:30 pm - In: Event

Pages Analysed

380,000

Legislatives tracked

493

Articles Posted

1281

Global Firms Engaged

200

Our accomplishments

We are not consultants and do not offer legal advice – for 8 years we have been using data science and natural language processing to regain control

Collaborative

We have run over 400 working group meetings since 2006

Laser Focused

We post hundreds of alerts and since 2012 we have received over 1,000,000 page views

Award Winning

RegDelta has won multiple awards since it was commercialised in 2014

Thought Leading

Founding member and currently hold the chair of the prestigious RegTech council

Get Engaged

Our goal is for you to be in the right place, at the right time, to understand how regulatory policy can be delivered and implemented better, faster, cheaper and safer.

To promote global dialogue on how to deliver regulatory change JWG post hundreds of focused articles a year to thousands of subscribers. Get involved and join the mail list.

By hitting the subscribe button you agree to our Privacy Policy

Latest from RegTech Community

April 23, 2024 2:00 pm - In: Event

April 12, 2024 5:00 pm - In: Event

March 19, 2024 6:00 pm - In: Event

March 15, 2024 1:30 pm - In: Event

Get to know RegDelta™

Our industry leading RegDelta™ platform hosts a semantic rule book for regulators, financial institutions and technology companies. Powered by JWG regulatory analysts, we use highly advanced tools to scan, scrape and enrich content; helping businesses understand and manage regulatory risk in a more efficient and economical manner.