Introducing RegTechFS Hubs

Our ‘safe spaces’ have helped a heavily regulated industry without a prescriptive approach to solutions tackle trading, surveillance, reporting, AML/KYC, infrastructure and industry governance solutions in an independent manner.

There is a new world out there.

The world has changed and we need digital spaces to facilitate the dialogue. The RegTech Hub offers Financial Services professionals a unique opportunity to JWG produced and curated intellectual property so you can learn about the regulatory challenges, how new technology is enabling better compliance and what the leaders are doing to both change and run their compliance functions better, faster, cheaper and safer.

You will find articles, webinars, papers, conferences, special interest groups, and links to the latest online discussions.

Become a RegTechFS Hub memberSignup is free, fast and secure.

The RegTechFS Hubs

Subscriber level membership is free to financial institutions and within each hub members have the opportunity to engage in deeper collaboration. If you would like to get involved, promote your viewpoint, engage in industry projects or learn more about how the JWG team can help, please contact us

Reporting & Reference Data

This hub covers reporting to regulators including: transaction reporting, trade reporting, prudential reporting, identifiers.

Sign up for free

Digital Integrity

This hub covers regulatory challenges for technical infrastructure including: cloud, data, new technology and risk controls.

Sign up for free

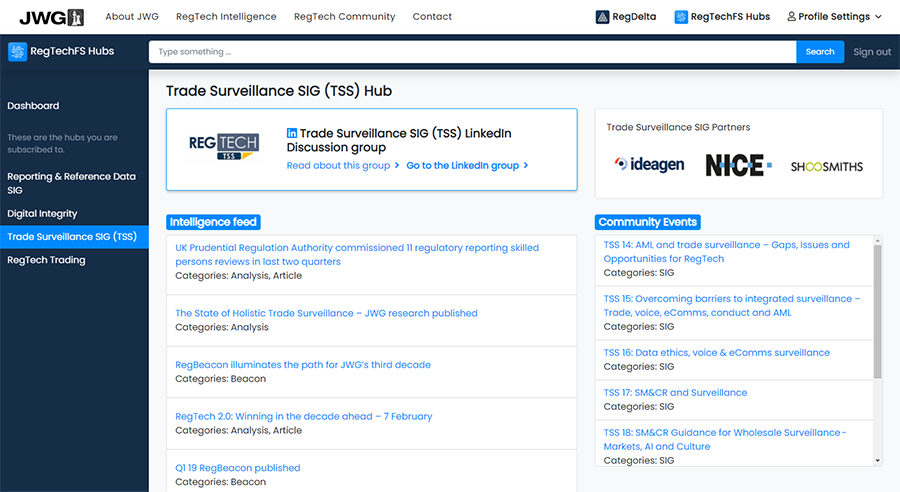

Trade Surveillance

This hub covers the patchwork of regulations which govern the way firms manage trading risk including: eComms, voice and trade surveillance.

Sign up for free

Client Management

This hub focuses on the regulatory fight against financial crime and how PET, AI/ML and semantics can achieve better outcomes.

Sign up for free

RegTech Trading

This hub covers trading issues of what can be traded, where it can be traded, which types of firm can trade it and what systems they need to have in place to do so.

Sign up for free

RegTech Council

This hub covers the way regulators and regulated are governing the way regulations are developed, implemented and monitored.

Sign up for freeGain access to exclusive LinkedIN discussion groups.

RegTech: Reporting and Reference Data

This group covers reporting to regulators including but not limited to transaction and prudential reporting. We get into the details of reporting formats, standards and collection mechanisms as well as data models and gap analysis across comparable regimes. We analyse how Digital Regulatory Reporting, Common Domain Models, Data Point Models, ISO 20022 dictionaries, XBRL taxonomies and Machine Readable rule books can help.

The discussions take a global perspective and cover OTC regulatory reporting efforts including EMIR, CFTC, MAS, etc, and CPMI/IOSCO oversight. We discuss MiFID/ MiFIR, Dodd Frank, CAT, SFTR and other regimes. We also cover Prudential and statistical reporting including Basel directives like CRR in the EU.

RegTech: Digital Integrity

Financial Services is the largest, most regulated sector running on unregulated infrastructure across the globe. This group tracks the evolution of a regulatory risk management framework to address cloud concentration risk, machine learning, data ethics, data quality, cyber security and other technical issues which create systemic technology risk blind spots.

We will examine the treatment of what is viewed today as non-financial risk across a number of disciplines: operational risk, BCBS 239, operational resilience, cloud concentration risk, third party vendor management, privacy (including privacy enhancing technologies), encryption, data quality, AI, Machine Learning and distributed ledger technology.

RegTech: Trade Surveillance

Expectations from regulators for eComms, voice and trade surveillance technology in Financial Services have skyrocketed along with market volumes. RegTech can help cut the cost of billions of false positive alerts while improving oversight.

In this group we will help shape the dialogue across a patchwork of global regulatory obligations including: Market Surveillance (e.g., MiFID, MAD/R), Conduct, Culture, AML/CFT, AI, Data Ethics, Operational Risk and Senior management accountability regimes (SM&CR, ESMA/EBA suitability guidelines).

RegTech: Client management

Political will to prevent financial crime is increasing and the focus on how firms know who they are dealing with and the purpose behind their activity is increasing fast. New technology like privacy enhancing technology (PET), AI, Machine Learning and Semantics can help.

This group takes a global perspective on the holistic obligations for managing a client. We cover trading obligations which affect the classification of a client, AML, Anti-Terrorist Financing, Tax Crime and surveillance obligations.

MiFID III: EU, UK and Global trading RegTech

As global politics realign, the market structure is changing with it. Europe's Capital Markets Union initiatives will tackle pre and post trade obligations, consolidated tapes, market data costs, high frequency trading, investor protection, client classification, product governance, research and record keeping. Keep track of the discussions here and help us frame the global RegTech Trading debate!

JWG are recognised by regulators, financial institutions and technology firms as the independent analysts to help determine how the right regulations can be implemented in the right way. Our independence permits us to collaborate with regulatory and industry bodies, financial institutions and technology firms without serving the interests of any constituent over another.

RegTech Council

RegTech is now a sector defined as the use of emerging technologies by both financial institutions and regulators to make the writing, communications, interpretation, implementation and monitoring of regulations both more effective and efficient. With a groundswell of support, JWG have launched a committee of individuals who work for regulators, financial institutions, academia, standards bodies, professional services firms and the technology supply chain to examine the requirements for a new method for public/private sector collaboration to explore how technology can provide better methods of compliance and oversight.

The Council focuses on international RegTech adoption and longer-term R&D for the sector as it drives a portfolio of enabling projects to explore, test and evaluate the application of new technologies and their resulting digital assets. Over 10,000 collective hours has been contributed to meetings, research and PoCs since May 2017.

RegTech Intelligence

The RegTech Intelligence Hub gives you access to thousands of insights through in depth articles, reports and analytics covering the constantly evolving world of regulatory compliance.

Explore RegTech IntelligenceRegTech Community

RegTech Community is a dedicated safe space where financial institutions and their suppliers come together to navigate the constantly changing noise and learn how to comply.

Explore RegTech CommunityRegDelta Solutions

RegDelta Solutions is an enterprise class product created by us that utilises state of the art AI Machine Learning to help you navigate regulatory noise and achieve total compliance.

Explore RegDeltaGet Engaged

Our goal is to be in the right place, at the right time, to understand how regulatory policy can be delivered and implemented better, faster, cheaper and safer.

To promote global dialogue on how to deliver regulatory change JWG post hundreds of focused articles a year to thousands of subscribers. Get involved and join the mail list.

By hitting the subscribe button you agree to our Privacy Policy

Latest from RegTech Community

June 11, 2024 2:00 pm - In: Event

May 16, 2024 4:00 pm - In: Event

April 24, 2024 2:00 pm - In: Event

April 12, 2024 5:00 pm - In: Event