RegTech Community

RegTech Community

Working Group

Global Derivatives Digital Regulatory Reporting Programme

RSS Feed

November 15, 2022 3:00 pm

ArchivedOnline

DRR Programme

JWG, together with leading trade associations and standards bodies have launched a collaborative project to digitize and elaborate existing reporting best practice, produce machine-readable test scenarios and machine executable rules.

DRR definition

JWG consider Digital Regulatory Reporting to be broadly considered the digitisation of reporting instructions, with reference to an agreed model to make the current manual reporting processes more accurate, efficient and able to produce better transparency for supervisors

Background

The CPMI/IOSCO mandated derivatives reporting rewrite has an ambitious timetable. Hundreds of systems will need to be recalibrated to the new data schema and extensive testing completed by 2022.

JWG Position

Founded as a Joint Working Group for MiFID I, we have 15 years of experience in building high trust groups in Capital Markets. JWG provides market intelligence and is the Secretariat Derivatives DRR project.

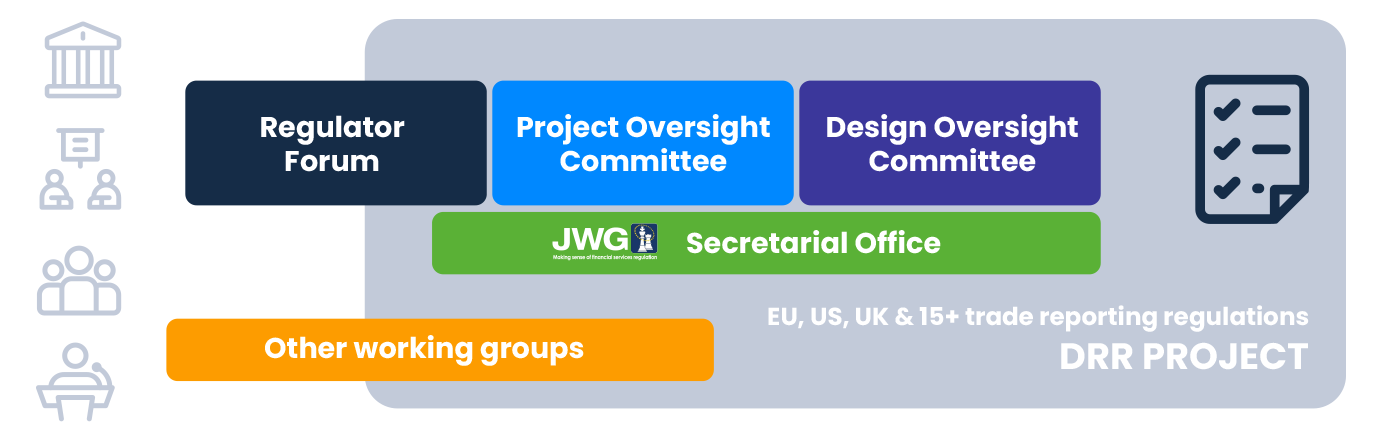

Industry Governance

The programme will be governed by the Global DRR Regulator Forum, Project Oversight Committee and Design Oversight Committee. Trade associations, Firms, Regulators, Reporting FMIs and Vendors will participate on these committees.

Projects

A formal Terms of Reference for the European and UK Derivatives DRR project specifies the project scope, resources required, plan, deliverables, method, and assumptions. This document is available upon request.

Deliverables

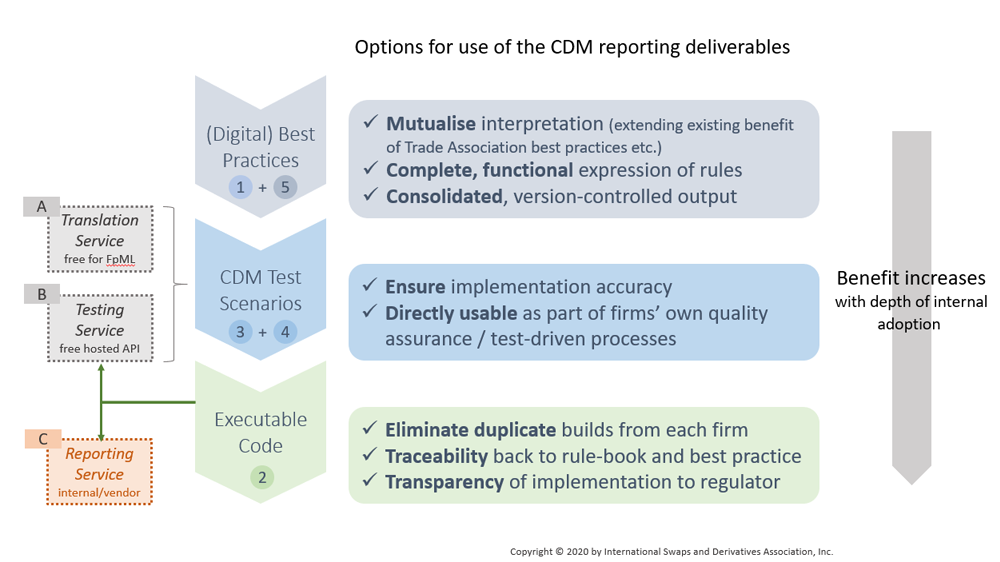

Adoption of the CDM will result in more accurate reporting and a high matching rate. Once the reporting rules are digitized, any future changes to the requirements can be easily updated in the CDM and consumed by firms with little cost of time:

Benefits of Membership

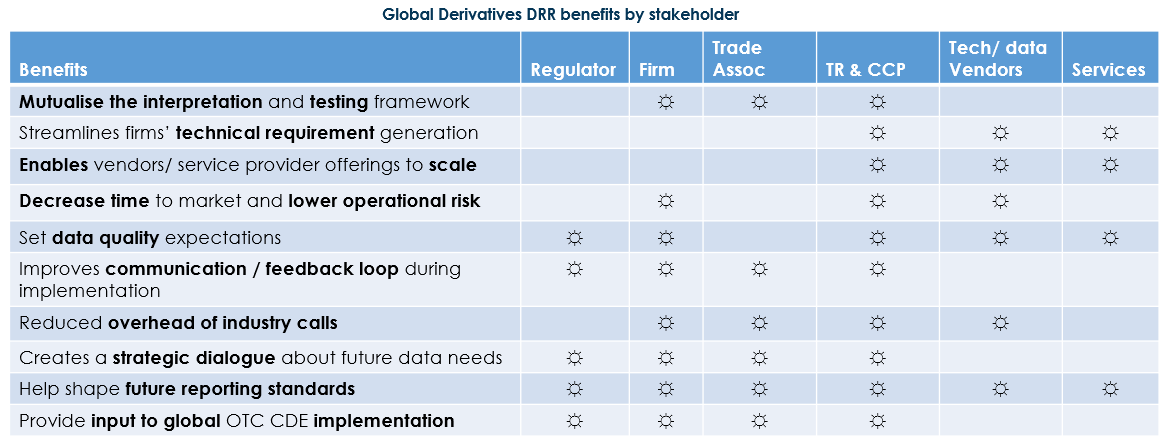

- Mutualised interpretation of reporting requirements and the testing framework, lowering total OTC reporting implementation cost

- Lower operational risk via the ability to share end-to-end requirements between regulators, firms, trade repositories, CCPs, application vendors, data vendors, and service providers

- Set quality expectations with regulators and provide an upgrade path for the next 3 years of migration CPMI/IOSCO standards

- Provide a method for rapid update for rapid rule update of OTC rules as technical standards and guidance (e.g., Q&As) can be published in both human readable and machine along with data models and machine interpretable language

- Creates a strategic dialogue between public and private sector that can shape future reporting approaches which may be extended to other regulation, including the US and Asia.

Benefits

All actors involved in regulatory reporting will achieve massive benefits from this programme:

Why Now

Return on investment for those at the table from the start will be high as strategic dialogues can begin, objectives aligned, and offerings architected to new standards that will be required by in firms by Q1 2021Firm Cost

Half a day a week of expertise and Committee representation is required but participation is free.Vendor Cost

£30,000 pa for large vendors and service providers; £20k pa for medium; £10k pa (all prices excluding VAT).Additional Contact

PJ DI GIAMMARINO, CEO

PHONE: +44 7811430503

PJ@JWG-IT.EU www.jwg-it.eu

Get Engaged

Our goal is for you to be in the right place, at the right time, to understand how regulatory policy can be delivered and implemented better, faster, cheaper and safer.

To promote global dialogue on how to deliver regulatory change JWG post hundreds of focused articles a year to thousands of subscribers. Get involved and join the mail list.

By hitting the subscribe button you agree to our Privacy Policy

Latest from RegTech Community

September 25, 2024 6:00 pm - In: Event

September 24, 2024 2:00 pm - In: Event

June 28, 2024 1:00 pm - In: Event

June 20, 2024 2:00 pm - In: Event

Get to know RegDelta

Our industry leading RegDelta platform hosts a semantic rule book for regulators, financial institutions and technology companies. Powered by JWG regulatory analysts, we use highly advanced tools to scan, scrape and enrich content; helping businesses understand and manage regulatory risk in a more efficient and economical manner.