European banks are currently living in a grey area when it comes to EMIR enforcement. By ESMA’s account, all institutions should by now have classified their counterparties to derivatives trades. However, the first tentative steps towards new utilities have yet to take root – so what kind of solutions will the industry opt for?

All parties trading derivatives were technically required to have classified their counterparties as of 15 March 2013. But the real deadline came in September with the requirement to finalise portfolio reconciliation and dispute resolution agreements with non-financial counterparties. In spite of this, as the FCA have confirmed, many are still in the early stages of determining their counterparties’ status.

But with the CRD IV deadline on 1 January 2014, and several more EMIR deadlines hot on its heels, the pressure to get Europe to a common solution for counterparty classification is rising fast. This coordination process requires not only senior management sponsorship, but also some sort of holistic solution that can solve for all situations.

Professionals are now engaged in sending hundreds of thousands of bilateral communications – letters, emails, phone calls, and even using google – to define each counterparty’s status. But this is an unsustainable approach – not only is it labour intensive and costly, but it also risks non-compliance if the classifications do not line-up across the firm. In the long run, the LEI might provide an answer – but for now, it is still only a small piece of the puzzle. And, with ESMA’s recent announcement that firms should only use endorsed pre-LEIs for EMIR reporting, pre-LEIs are actually adding pieces to the puzzle.

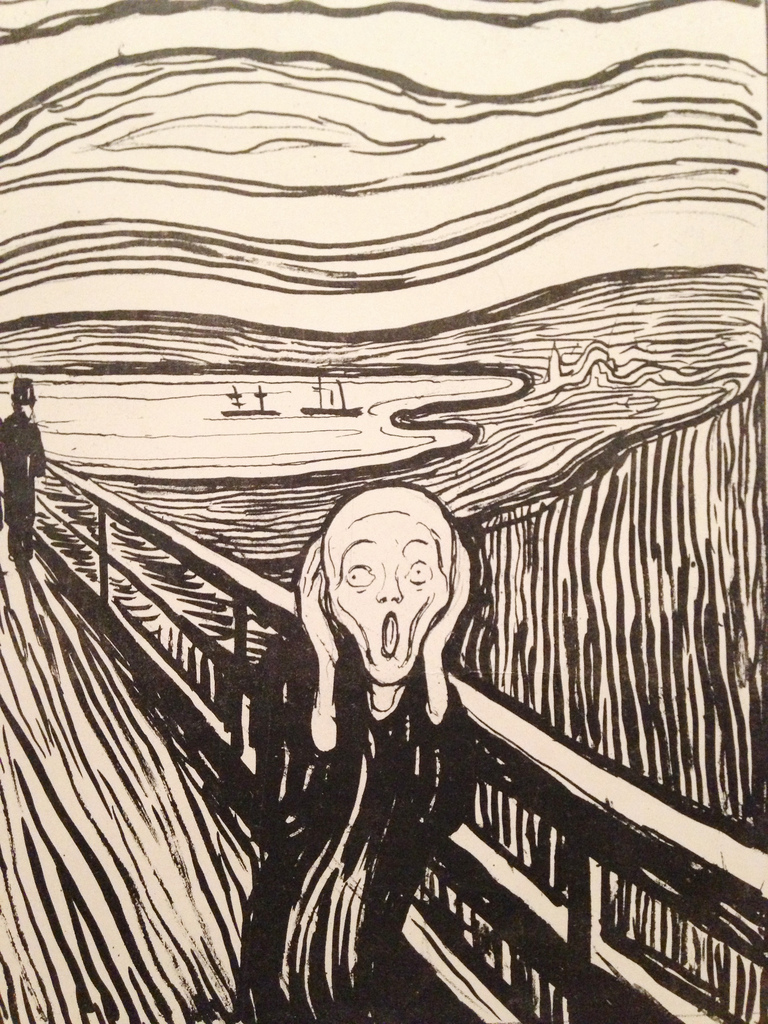

The fundamental challenge the industry faces is to define the way we communicate about our regulatory status. Classically, sell-side and buy-side work hard to standardise the way credit scores, ratings, prices and all market variables are communicated. And, because of the market-facing nature of the challenges, the data is generally kept up to date by utilities. Why? Because there is a well-honed feed-back mechanism that helps correct bad data: when it’s wrong, somebody screams.

This is why it is worth all the effort to make sure the data is right. But will anyone scream loud enough to make it worth all the effort to fill in bits of paper and stick them online and guarantee that regulatory status data – FC, NFC, NFC+ – is right?

Some think so. They are investing a lot of time and effort signing bits of paper – e.g., protocols – that declare status at a given point of time. The idea is that this information can then be collected by data vendors and added to other pieces of information that allow one to know who it is that signed the piece of paper. All of this needs to be ‘hard wired’ so that the use cases for the information are well understood by both lawyers and operations folks. Of course, the data vendor must hire people to help clarify all of this and, importantly, work with all parties to clarify and maintain the quality of the information in the system. Overall, this makes protocols a robust but costly approach. Needless to say, top tier firms are keen to share this cost with as many folks as possible and therefore want everyone to use the same utility.

Of course this is all early days and we don’t know whether we will have just one KYC utility. Let’s face it – we don’t even know to what extent the corporates or regulators will scream, when they will do it, and whether when they do that the decibel levels will be of similar levels.

What we do know is that it will take a lot of resource to collect the information that the regulators want today. It is also highly likely that the consequences of incorrect information will leak out over time. Furthermore, it is also clear that regulators will want more information in the future and the cost of collecting it in this manner is high. All this means that flexibility in the way we collect what regulators want to know, and the ability to change it as we go at low cost, is key.

In an age where we declare our relationship status on dating sites and our employment status on Linked-In, social media can provide an option. A closed social network could provide an answer to the resource intensive and complex requirements required by creating traditional utilities. Rather than paying to sign and post agreements and stick them in databases, a network in which counterparties keep regulatory andcommercial data current could provide an answer.

If financial counterparties embrace a social media-based approach in sufficient number, they will be able to monitor and maintain classification information as these things change. Done correctly, they can exchange contractual reassurances as needed and even change what is required to comply.

The bottom line: social networks might not be the first thing one thinks of when looking at a utility – but it is worth thinking about seriously. We will be working through these options and covering the issue more – so stay tuned.