JWG analysis.

Our jaws hit the floor when it was revealed at our CDMG meeting last week that ESMA’s MiFID II technical standards are expected to be in excess of 800 pages with more than 800 questions to be answered by August 2014.

And this is just the start. ESMA’s 2014 work plan has over 100 line items related to MiFID and MiFIR alone

Ok, it is likely to be easily separated into the urgent versus the important but, nevertheless, it will be a real wake-up call to the middle and back-office leaders at the key market players.

As previously reported, we have been following the trade associations’ preparations with interest and have identified large numbers of ‘known unknowns’ of a technical nature. The problem is we have very few resources ready and willing to come up with answers to the questions and, yes, the regulators really do want these answers now.

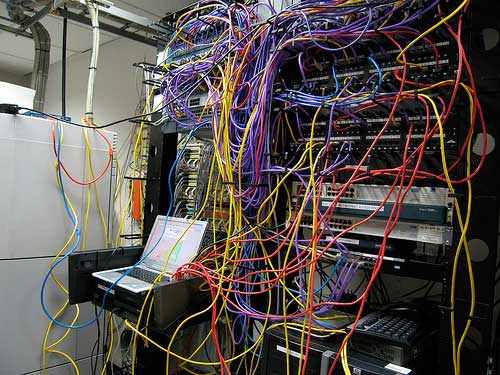

Have a look at our updated MIFID II heatmap (click to enlarge):

No, it’s not a joke. Politicians know trading conditions are tough, and that it is summer in Europe, and that giving ESMA a huge task like this is unfair – especially when the European Parliament is up for election. Do they care? Not really.

The fact is that their lords and masters have agreed in Brussels that this is when we define how the world’s most complex industry should work in 2016 and we have to get on with it. So, we face a big fork in the road – either the industry puts the technical resources in now to help the regulator work out how to set the rules, or we suffer the consequences … possibly 800 times over.

It’s likely to be quite a bumpy ride, regardless of which fork we take. Think of it as the equivalent of developing the business requirements definition documents for EMIR AND Dodd-Frank together by August. Here are 3 teasers from the CDMG minutes that are now available to members:

- Scope. If EMIR defers to the MiFID I definition of derivatives and, therefore, if the new MiFID/MiFIR changes the old definition, will it have a knock-on effects in terms of EMIR scope?

- Identification. Does anyone know how to identify a short sale? How will we keep private information about traders out of the public eye?

- Objectives. Transaction reporting used to be primarily for market surveillance but now has a broader, but not well articulated, set of purposes. What does this mean for the hefty set of operating manual procedures encapsulated in the Transaction Reporting User Pack?

Taking the ‘high road’ at the fork, we would see the best and brightest minds in the operational space taking on these questions starting in June. Not just a ‘change the bank programme’, the ‘run the bank’ experts would also be identifying which are the most important ‘known unknowns’ to make known and helping to suggest answers. Sell-side and buy-side would be setting their interests aside to present a common front to their suppliers and the regulators. Most importantly, they would be getting the data to support the right answer. But will this happen?

Maybe. Having taken advantage of the bright London sunshine to think about it this weekend, we reached the following conclusion. A shell-shocked industry is about to undergo a defining leadership test. Everywhere we look, there are signs of poor market conditions reducing budgets and pushing back on ‘change the bank’ initiatives. The EBA has even flagged ‘cost cutting’ as an operational risk.

Does this mean that we are constrained to travel on the ‘low road’ to a 2016 market transparency mess – à la EMIR? Perhaps not – but it does mean that if you are reading this, you’ll have to do something soon, if not now!

Currently, trade associations are mostly focused on issues of policy, and key market infrastructure suppliers are not necessarily at the table. This means that the conversations about these new technical standards do not have the relevant people and/or appropriate views represented. It does not have to be like this. If you care enough about the market to be reading this article, you should do at least 5 things now:

- Identify the right experts in your firm to take a view on the right MiFID issues, and

- Ensure they are attending the right Joint Trade Association Group (JTAG) working group meetings by checking with your industry relations specialist, and

- Get in touch with JWG to register your interest in attending our MiFID II deep dive sessions, and

- Brief your senior management on the cost implications on the 2015 budget, and

- Ask your incumbent market infrastructure providers how they are going to help.

We are reliably informed that trade associations are contacting the relevant policy experts within your institutions to explain the next steps. So far, we have spotted one out in the public eye here – see pages 37 to 40. No doubt the BBA and AFME will be posting shortly along with other JTAG members.

The next CDMG meeting on 12 June will focus on client disclosures, suitability and appropriateness and best execution. We won’t stop there. Governance and record keeping have also been mentioned as areas for further explanation. And, oh yes, we will have 800 more things to look at after that …