Over 40 senior professionals at JWG’s RegTech Capital Markets Conference unanimously stated that we are missing a governing body to assume responsibility for regulatory implementation.

It was a powerful discussion which agreed that a key piece of the jigsaw is missing; a strategic dialogue to focus practical regulatory reform implementation. There is a need to:

- Envision the target state (i.e., align implementation efforts across regulations)

- Curate the common artefacts (e.g., code base, data models, etc.)

- Stimulate the supply chain so they are ready when regulators want them to be.

As we indicated in the summary conclusions of the day, views about how to manage RegTech are starting to form and this governance body will play a part.

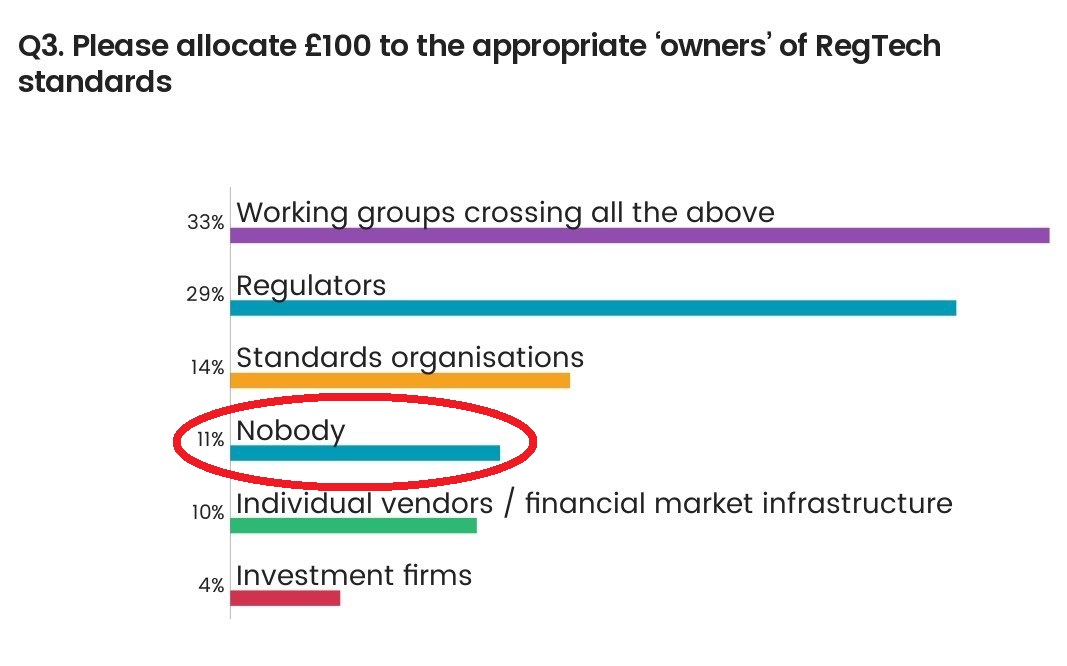

Have a look at the gap highlighted by the audience.

Source: delegate voting at JWG’s RegTech Capital Markets Conference, London, 28 February 2017

The problem is clear. Though regulators and working groups rank at the top, there is no place for them to meet to take that ownership of the RegTech agenda. In fact, 11% said that ‘Nobody’ owns RegTech! Why is it that no one knows who owns it? Something is missing.

Other industries are able to answer this question. Pharmaceuticals, oil & gas, automotive, technology and many other sectors have governing bodies for their infrastructure and which help them control risks. The standard models, methods, data sets and protocols that they employ translate into lower costs, increased efficiency, safety and validation of interpretation. If some of the fiercest rivals in the automotive industry can collaborate, why can’t we?

The computer industry, for example, moved from multiple product operating systems to consolidated, off-the-shelf solutions through the use of financial incentives. Other industries can do it, so why not the financial sector?

The bottom line is that the complexity and volume of the post regulatory reforms have broken the traditional methods by which technology companies meet our needs. As we stand here today, 8 years on from the crisis, we have no way to agree a global view of the infrastructure the industry needs to be compliant. There is no space to set a collaborative agenda for RegTech, curate common artefacts or stimulate the supply chain.

To get to a safer place, we need a platform to facilitate dialogue between the many actors in financial services – including firms, regulators, technology companies and standards bodies. If we want to achieve regulatory reform objectives before we are deep into the next crisis, this group needs to get moving soon.

If tens of thousands of financial institutions face the same regulatory requirements forcing them to behave in much more prescriptive ways, why wouldn’t they want to work together to reduce tens of billions from the cost curve for the industry?

A RegTech council could follow the blueprint of other industries and bring public and private sector interests into alignment. In short, it could help overcome the market failure many have noted in the RegTech marketplace.

We are missing the key piece of this puzzle. We lack the will to sit at a table together and make it happen. We need legitimate solutions that create standards by providing outside-in validation of interpretations. If we do not put these in place, all firms, their vendors and the regulators will suffer.

The general paradigm shift towards holistic and collaborative solutions is leading towards the creation of an independent body and heading towards rationalisation. This conference was an optimal example of just that shift. Members agreed that, in order to scale the mountain effectively, the entire ecosystem, from regulators to firms, technology companies and industry thought leaders, needs to communicate successfully and openly to improve efficiency and exist in better markets.

In sum, to capture the significant advantages from filling in the missing piece, a RegTech council could provide the foundation and framework:

- Safe, uniform, terrain for solid plans

- A way to certify ‘compliant’ solutions

- Long-term reduction in costs

- A platform to discuss realistic implementation deadlines

- A path to proper utilities.

It’s a big idea, but we think the industry is ready for it. We are now at a tipping point, with more prescriptive regulation forcing a change in approach and much reworking will be needed in the upcoming political realignment.

We are beginning to ascend the mountain, but the path will not be without its bumps and there are many practicalities to address. To overcome these challenges, we need to find this missing piece of the puzzle, the platform in which key players work together to solve common challenges.

We will shortly be releasing a position paper and arranging follow-up event specifically on this issue. Please email info@jwg-it.eu if you would like to get involved.