After the financial crisis in 2008, there was an effort to put in place regulation to support the markets and prevent such a crisis in the future by, in the words of Mark Carney, moving the global financial system “from fragility to resilience”. In his recap of what a difference a decade makes, however, we noted a new driver. No longer are the G20 talking merely talking about resilience, our economic masters have noted that “reform implementation must not only be effective but also dynamic. The objective isn’t just resilience, but ‘efficient resilience’”.

Why? Well, as we have maintained on these pages for a while now, in the rush to fix the system, something vital was missed: a common place for the FS infrastructure to work out how it was going to implement one of the most complex change programmes any information industry has ever seen. In other industries, there are common, verified models and solutions to common problems, but the financial sector does not have that system in place.

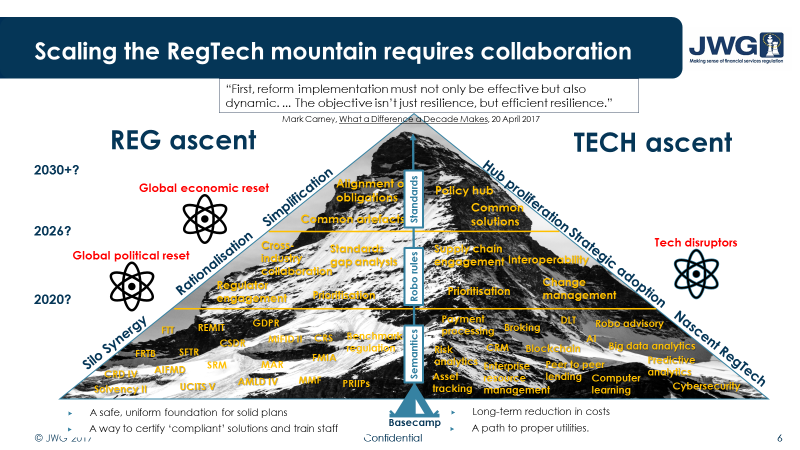

Even the language that the sector uses to describe regulatory obligations and how they are met is different across firms, regulations and even departments. To increase efficiencies and survive in the ever-increasing flood of regulation, it is essential that we begin the ascent to the summit of the RegTech mountain where these collaborative systems in are place.

We are currently in a disruptive period that is tumultuous with elections and regulation. To safely traverse this turbulence, there needs to be collaboration and oversight of RegTech solutions – a living system that is effective and dynamic. There are obvious advantages to a collaborative approach, as mentioned in our previous article, but, currently, firms are trying to solve common issues individually, which is costly and inefficient. At the top of this mountain is a state where the industry collaborates to identify the areas of common interest, cooperatively creates solutions and has them verified and achieves this holy grail of efficiency.

What is ‘efficient resilience’? Although this might refer to the industry being more resilient through regulation, it can also be seen as making the industry more efficient in general and, therefore, more resilient to the challenges it might face. This is what is at the summit of the mountain, a resiliency through efficiencies delivered by collaboration and dialogue on common issues and solutions. It also is applicable to the industry being more resilient to the waves of regulatory reform, through increased effectiveness, as a result of standards.

In the diagram, there are three parts to the mountain ascent, which are linked into the view at the summit. At the bottom is ‘Semantics’, an issue that underpins the whole mountain. There is currently a semantic issue in the sector which is crippling the ability to be efficient. The lack of common vernacular is preventing common technology solutions and standards. It is a huge pain point – the need to interpret and map the meanings of various terms across different regulations, departments, firms, vendors. A RegTech Council could help pave the way to a common language for regulation. From the same data being named in multiple diverse ways, rendering the landscape inefficient and unwieldy, to one that is rather more uniform, laying the foundation for shared RegTech solutions, as well as various other efficiencies across businesses and the industry as a whole. At the summit, there is a body, a RegTech Council, filling in the missing puzzle pieces of regulatory reform, overseeing the efficient curation of verified common artefacts, models and solutions to regulatory burdens; a platform to facilitate dialogue between the key players. This body will be able to unite the disparate dialogues on regulatory implementation and provide a stable and uniform approach to the perpetual waves of regulation.

Once common semantics are used as a shared base, a key factor at the top of the mountain, there can be ‘Robo-Rules’, automated regulation based on the common vernacular. The rationalisation of regulation improves its interoperability and increases the efficiency and effectiveness of the compliance process. The future of FinTech is in machine learning and automation, using AI for regulatory rule interpretation … but this is not possible without semantic alignment.

Completing the mountain, is ‘Standardisation’; the common artefacts, based on the robo-rules in the shared semantics, an opensource of verified solutions and aligned obligations. These various levels create a world where regulation and compliance solutions are quicker, cheaper and more efficient through the use of standards and collaboration.

At the top of the mountain are various operational efficiencies and incentives, some known and others that require discussion and progress. There needs to be a new regulatory effort track that aims to achieve these key goals.

- By reducing spend on consultancy, firms can free up resources to devote to the governance of a RegTech Council which would ultimately be more cost efficient. Currently there is no clear view on how firms could get capital relief for good RegTech and so research, as well as supervisory involvement, is needed in this space to investigate the issue further

- Verified, collaborative artefacts will make it easier to spot opportunities early to capitalise on opportunities to make solutions to regulatory burdens better, faster and cheaper. A RegTech Council could provide this adaptability and, through better governance, will be able to pull in better solutions more quickly and efficiently

- Oversight of results, a register of verified RegTech solutions, would improve the safety and competence of firms’ responses to compliance challenges, kitemarking the vetted solutions in the various RegTech areas

- Empowering solutions for the market through behavioural adaptions, such as larger firms assisting smaller firms with compliance burdens.

Due to the scale of the task, it is important to have use cases which generate business value to get us on the right paths. In the words of Marion Wright Edelman, “If you don’t like the way the world is, you change it. You have an obligation to change it. You just do it one step at a time”. Sadly, there is no way to jump to the top – no matter how much money we throw at this mountain, it keeps getting bigger as we rush to meet quarterly implementation targets. We cannot do it all at once.

The great news is that, this month, the first steps towards the creation of the RegTech Council have been taken. With a groundswell of support, JWG have launched a committee of individuals who work for regulators, financial institutions, academia, standards bodies, professional services firms and the technology supply chain. This independent committee to establish the RegTech Council will examine the practical challenges, starting with 3 key tracks:

- New regulatory efforts. The need to spot obligations early in order to capitalise on opportunities to act better, faster and cheaper

- Thematic regulatory efforts. Top priorities noted were reporting, client and identity, infrastructure and data

- Organisational and political track. Governance, operating model, participation, endorsement and other challenges are the first steps.

What is the prize at the top of the mountain? There are significant advantages from filling in the missing piece; a RegTech Council could provide the foundation and framework for:

- A safe, uniform foundation for solid plans

- A way to certify ‘compliant’ solutions and train staff

- Long-term reduction in costs

- A platform to discuss realistic implementation deadlines

- A path to proper utilities.

Do you see other opportunities at the top of the mountain? How would getting there quicker help you? To get involved in the June meeting please contact regtechcouncil@jwg-it.eu