Working late into Tuesday night, European lawmakers concluded a compromise over the new Markets in Financial Instruments Directive (MiFID II). The final text has not yet been made public, and is not expected for several days. However, some details have emerged.

Concessions had to be made on both sides, with the Parliament advocating for robust protections for end consumers, and Member States being lobbied heavily by the industry to soften some of the bigger changes. Therefore, the compromise looks a little odd in places: For instance, based on the Commission’s press release, consumer protection controls (some at the product design stage), product suitability assessments and client disclosures look to have been stepped-up. In contrast, however, new rules around FMIs linking services have been added and dark pool transparency for non-equity instruments appears to have been relaxed.

Rules around commodity position limits and the introduction of testing, authorisation and operational risk controls for algorithms remain a key part of the legislation. However, early indicators suggest that the severity of these rules will greatly depend on how ESMA and the national authorities exercise their discretion when implementing them.

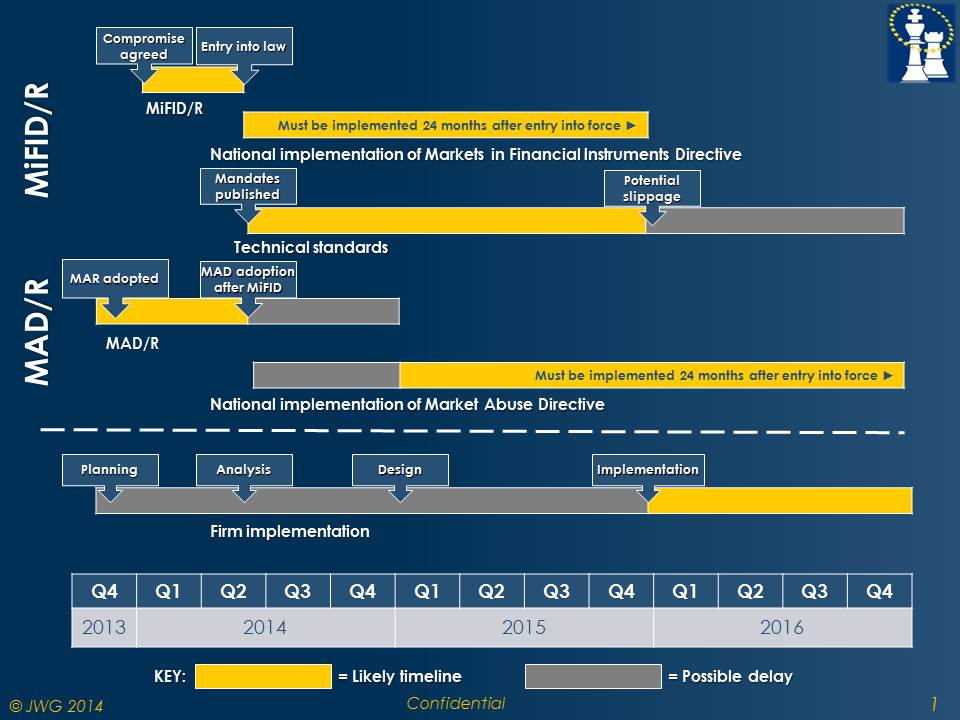

What is certain is that the timeline has shifted significantly, with full implementation pushed back to 2016. However, based on previous experience, firms should not let down their guard, as technical standards could arrive as early as this year, and will figure into how firms are implementing for EMIR and other regulations.