Crypto market capitalization has receded by nearly 75% as $2 trillion were wiped off the market[1] leaving many crypto investors to reflect on the words Warren Buffet: “You only learn who has been swimming naked when the tide goes out”.

Rulemaking continued to push the digital-asset agenda forward over the summer with over 3,000 pages published by EU, UK, US and international policy makers. In this article we look back at the market collapse and the drivers behind the new, global laws.

The race to digital asset certainty is on and we are looking forward to discussing the critical role of international standards in helping to digitize compliance and make it safe for the tide rise again at our annual virtual conference on 9 – 10 November which is also available on demand for 6 monhts.

Looking back

Crypto enthusiasts would argue that the decentralized nature of the crypto offered a conducive environment for innovation, allowing full ownership, confidential and near instant international transfers, leading to the explosion of crypto trades. However, in reality, a large number of retail investors were attracted to crypto by huge returns promoted by celebrity advertisements[2] (many which later turned out to be nothing but another variation of the old ‘pump and dump’[3] scheme) and promise of quick riches fueled by fear of missing out (FOMO).

Crypto sceptics will point to the lack of intrinsic value[4], regulatory safety net and backing by institutional funds as a clear indicator that the party would not last, and yet still many investors were caught by surprise as the fire of Fear, Uncertainty and Doubt (FUD) started to spread into markets that were previously seen as stable.

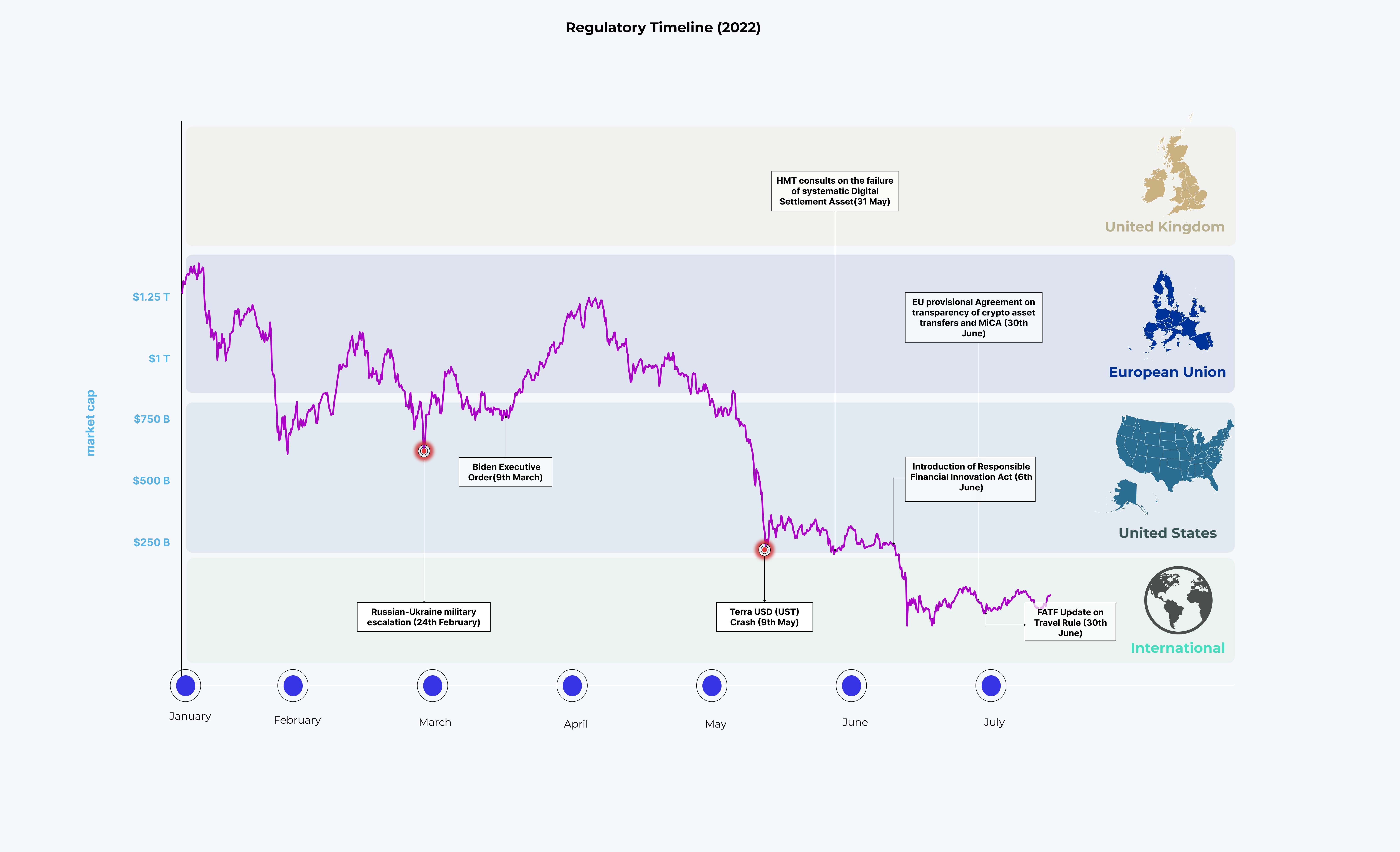

Both enthusiast and sceptic camps now recognize the inevitability of tough new rules which fast-moving regulators began to debate in anger this year. Exhibit 1 illustrates the market and the regulatory reaction.

Exhibit 1: Cryptocurrency market capitalization and the regulatory agenda

Source: JWG analysis of public sources, August 2022

As we highlighted in our March article, the Presidential Executive Order fired the starting gun for the US’ race to control digital assets. The market downturn has provided not only more urgency to get through the legislative process, but also littered it with obstacles.

Flaws exposed by Terra (UST)

Stablecoins are a popular class of digital asset that promised investors a safe haven against the price swings of other crypto assets by pegging themselves against fiat currencies on a 1:1 basis. By October 2021, the value[5] of stablecoins outstanding stood at around $130 billion.

TerraUSD (UST) was one of the most prominent stablecoins that relied on an algorithm that tried to maintain a 1:1 value by increasing or decreasing its supply of sister token LUNA. When the stablecoin traded above its pegged value, additional tokens were created, and the price was expected to come down. When the stablecoin traded below the dollar peg, more tokens were taken out of the circulation and the price was expected to come up. This approach meant that stable value could be maintained only if people believed in the value of the token. However, trust is a scarce commodity and when markets turned red, a series of events led to a 1:1-dollar de-pegging, reducing the value of UST nearly to zero. While Terra was not the first stablecoin to fail it was certainly one of the most impactful as nearly 45 billion of market value were wiped[6] prompting regulators to act.

The collapse was noted as one of fundamental structural flaws within the crypto market, highlighting the need for a wider approach from regulators who have been playing catch-up all this time. Fabio Panetta, ECB board member in his April speech[7] acknowledged that at that time the crypto market was larger than the subprime mortgage market which triggered the global financial crisis. Sir Jon Cunliffe, Deputy Governor at the Bank of England compared the two events in his speech and stated that 95% of the $2.3 trillion[8] the crypto market is unbacked and needs to be regulated as fast as it is growing.

AML / Sanctions challenges

The crypto crash and financial stability were not the only triggers for regulators to get involved. The decentralized nature of cryptocurrencies almost from the beginning has been attracting not only those seeking anonymity for privacy reasons, but also those trying to avoid existing AML rules and global sanctions of the regular financial system. Virtual currency mixers such as the sanctioned Tornado[9] allowed individuals and organized crime organizations to launder more than $7 billion worth of virtual currency since its creation in 2019.

Attempts to bring crypto transactions within existing AML frameworks were previously made by international regulators such as FATF [10], whose “Travel rule” recommendations for virtual assets and virtual asset service providers has been out since 2019. However, progress has been limited as only 11/98 jurisdictions have started enforcement and supervisory measures since June 2021 according to the latest update [11].

It looks like things might speed up as regulators have signaled their intent to plug existing AML holes for decentralized finance, recently heavily criticized for its role in potentially enabling Russia to undermine heavy sanctions [12] that have been placed on it since the start of Russian-Ukraine war.

Moving forward

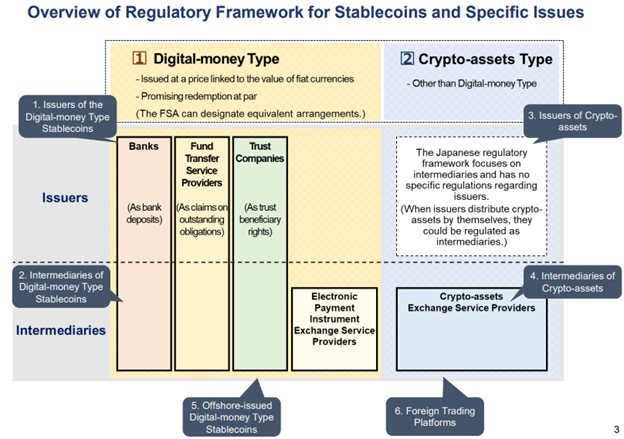

Across the globe regulators are crafting policies that will ensure financial stability, protect the consumers and protect the system from being exploited by bad actors. There is no internationally recognized set of digital asset problem statements but the Japanese FSA has recently summarized their policy challenges in exhibit 2.

Exhibit 2: Regulatory Framework for Crypto-assets and Stablecoins (JFSA)

Source: Japanese Financial Services Authority, September 2022 here

The EU Council presidency and the European Parliament issued 2 agreements to strengthen the EU’s anti money laundering and countering terrorist financing (AML/CFT) rules [13]. These are the MiCA provisional agreement [14] and information accompanying the transfers of funds (the travel rule agreement [15]).

The main objective of the European regulations is to reduce the anonymity of crypto transactions by ensuring that Crypto Assets Service Providers (CASPs) are able to provide information on the parties across the chain, including in the transfers of crypto assets.

In the UK, HM Treasury recently issued a response[16] to their 2021 consultation[17] on their approach to crypto assets, stablecoins, and distributed ledger technology in financial markets. In this response, the UK Government is looking to minimize the risks associated with stablecoin adoption as a means of payment by changing the definitions of existing regulations e.g., Banking act 2009, Electronic money 2011 and Financial Services (Banking Reform) Act 2013.

In July the Financial Services and Markets Bill was introduced to UK Parliament. It is designed to create an open, green, and technologically advanced Post-Brexit financial services sector. The bill will modify existing banking regulations to include stablecoins and other crypto assets. Treasury will be given the right to create rules for Digital Settlement Assets (DSAs) which are defined as “a digital representation of value or rights” which rely on DLT for payments and trading. The Bill is expected to make its way through the House of Commons by late 2022.

In the US, the Senate introduced the Responsible Financial Innovation Act [18] in a new bill in June. This act looks to create a regulatory framework for digital assets in the United States. In July, the Senate also published a draft Stablecoin TRUST Act which establishes a new regulatory framework for payment stablecoins. Among other things, the framework covers topics such issuance of stablecoins, consumer protection and privacy.

US developments come in the wake of President Joe Biden’s executive order[19] on Ensuring Responsible Development of Digital Assets that was issued on 9 March. The order’s main objective was to establish more federal intelligence and governance over cryptocurrencies. On 16 September the White House released a Comprehensive Framework for responsible development of digital assets.

An aspect of the framework which is most welcomed by the digital asset community is international collaboration. The Framework asks US agencies to expand their leadership roles on digital assets work at international organizations and standard-setting bodies (e.g., G7, G20, OECD, FSB, Financial Action Task Force (FATF), and ISO). It asks agencies to “promote standards, regulations, and frameworks that reflect values like data privacy, free and efficient markets, financial stability, consumer protection, robust law enforcement, and environmental sustainability.”

The key to a global digital market is to have digital standards that are fit for purpose. There will be more regulatory and market waves to come, but for the tide to rise again global standard setting needs to move to the next level.

If you want to learn more about the future of digital assets and the road to digitally-native compliance, join us for our 7th JWG virtual conference, on 9 and 10 November 2022. Registrants will be able to access all panels for 6 months.

[[2]] https://www.sec.gov/news/press-release/2018-268

[[3]] https://www.bbc.com/news/technology-59964648

[[4]] https://www.bankofengland.co.uk/speech/2022/july/jon-cunliffe-speech-on-crypto-market-developments-at-the-british-high-commission-singapore

[[5]] https://home.treasury.gov/system/files/136/StableCoinReport_Nov1_508.pdf

[[6]] https://www.bloomberg.com/news/articles/2022-05-14/terra-s-45-billion-face-plant-creates-a-crowd-of-crypto-losers

[7]] https://www.ecb.europa.eu/press/key/date/2022/html/ecb.sp220425~6436006db0.en.html

[8]] https://www.bankofengland.co.uk/speech/2021/october/jon-cunliffe-swifts-sibos-2021

[9]] https://home.treasury.gov/news/press-releases/jy0916

[[10]] https://www.fatf-gafi.org/media/fatf/documents/recommendations/RBA-VA-VASPs.pdf

[[11]] https://www.fatf-gafi.org/media/fatf/documents/recommendations/Targeted-Update-Implementation-FATF%20Standards-Virtual%20Assets-VASPs.pdf

[[12]] https://www.weforum.org/agenda/2022/07/sanctions-future-of-decentralized-finance/

[13]] https://www.europarl.europa.eu/thinktank/en/document/EPRS_BRI(2021)699467

[14]] https://www.consilium.europa.eu/en/press/press-releases/2022/06/30/digital-finance-agreement-reached-on-european-crypto-assets-regulation-mica/

[[15]] https://www.consilium.europa.eu/en/press/press-releases/2022/06/29/anti-money-laundering-provisional-agreement-reached-on-transparency-of-crypto-asset-transfers/

[[16]] https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/1088774/O-S_Stablecoins_consultation_response.pdf

[[17]] https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/950206/HM_Treasury_Cryptoasset_and_Stablecoin_consultation.pdf

[[18]] https://www.govinfo.gov/content/pkg/BILLS-117s4356is/pdf/BILLS-117s4356is.pdf

[[19]] https://www.whitehouse.gov/briefing-room/presidential-actions/2022/03/09/executive-order-on-ensuring-responsible-development-of-digital-assets