Senior managers have 163 days left to get ready for new rules in Ireland which will become effective on the 31st December 2023.

In the wake of the pandemic, FinTech and digital assets have become real, the next big round of post-crisis derivatives reforms is in here, trading rules are being rewritten and the regulatory framework has been extended to include ‘how’ operations are conducted. All of these changes need to be taken into account for the biggest regulatory driver of them all: senior management accountability.

Join our next global virtual seminar on 29 June to hear how the leaders are deploying proven RegTech to help senior managers sleep at night.

Register for 29 June 2023 virtual pass

Context

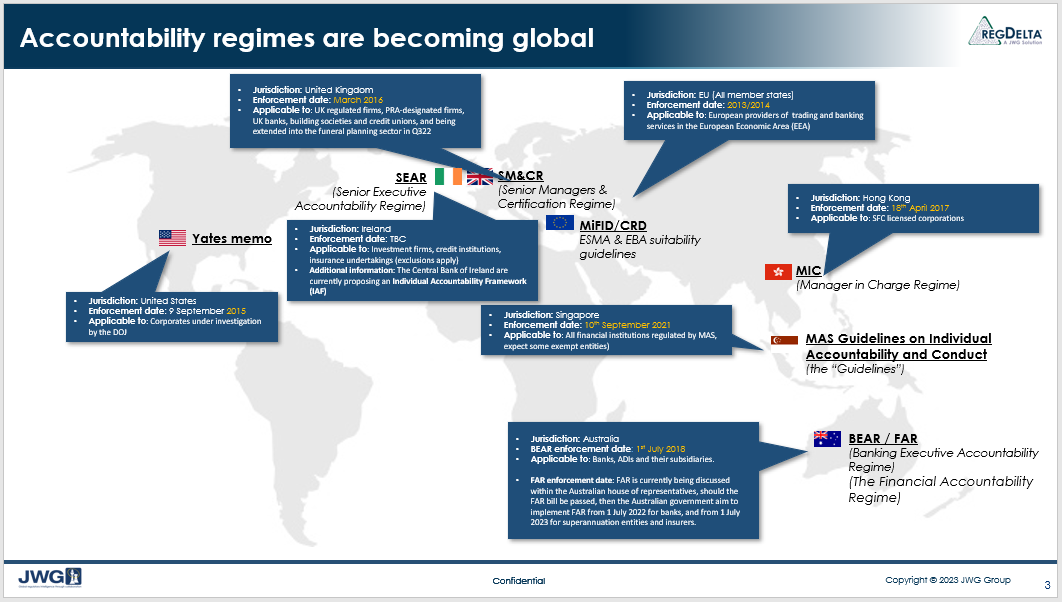

JWG has analysed the Individual Accountability Framework and compared the requirements against existing accountability regimes across the globe. Initial findings suggest that the Irish regime will be on par with the global baseline and have used the UK’s SM&CR as a “spring-board” to develop SEAR.

Since 2015, regulators across the globe have been pushing for stricter accountability measures to ensure that senior executives and employees are held responsible for their actions.

New board-level demands require more integrated tooling, digital standards and better ways of working. New accountability regimes will be used to impose painful sanctions which could include losing the right to work in the industry and jailtime.

Ireland

In Ireland, the Central Bank of Ireland has promoted accountability in financial services through the Individual Accountability Framework (IAF) and Senior Executive Accountability Regime (SEAR). The IAF’s main goal is to give the Central Bank of Ireland the authority to strengthen and improve personal responsibility in the financial services sector.

The IAF will work in conjunction with SEAR, which requires firms to identify their most senior staff and allocate specific responsibilities to each of them. SEAR also requires firms to document the wider governance and management arrangements of their Risk Function Support Person (RFSP).

Senior executive functions (SEFs), will include inherent responsibilities that will apply automatically. SEFs will need to clearly state responsibilities and management and governance structures – including responsibility maps.

SEAR requires a legal “duty of responsibility” to take reasonable precautions to prevent rule violations for the area of personal accountability. Non-executive directors will also be in scope.

The Department of Finance announced that the IAF will become effective on the 31st December 2023, and the public consultation will close on the 13th June 2023.

The Central Bank of Ireland has already started to prepare for these changes. In a recent speech, Derville Rowland, Deputy Governor, at the Central Bank of Ireland emphasized the need for sound governance throughout the financial industry and the role the IAF will have in achieving this goal. Domhnall Cullinan, Director of Insurance Supervision at the Central Bank of Ireland, urged firms to familiarise themselves with their responsibilities under SEAR, to implement procedures that comply with the Act, and train their staff on their obligations.

To ensure that the IAF works effectively, there are a number of amendments to the legislation which underpins the ASP (administrative sanctions procedure). Key changes include:

- In order to facilitate individual accountability of the pertinent individual, the Bill makes changes to the “participation link” by replacing the idea of a “person concerned in the administration of an RFSP” with that of a “person executing a regulated function.”

- The “settlement procedure” is subject to High Court monitoring, which means that no punishment imposed by the Central Bank will take effect until it is upheld by the High Court.

- Unless the High Court finds that the Central Bank “made a legal error” in its decision or that a punishment is clearly excessive, it will uphold the ruling.

- No High Court approval is necessary if a settlement is reached without the party under investigation acknowledging any of the stipulated contraventions.

- The Bill also lists a number of pertinent factors that the Central Bank must examine when deciding whether to apply a sanction, what kind of sanction to impose, and how much of a financial penalty to impose. These factors include, among others, the individual’s level of seniority and authority inside the company as well as whether or not their actions were willful, careless, or dishonest.

Accountability RegTech

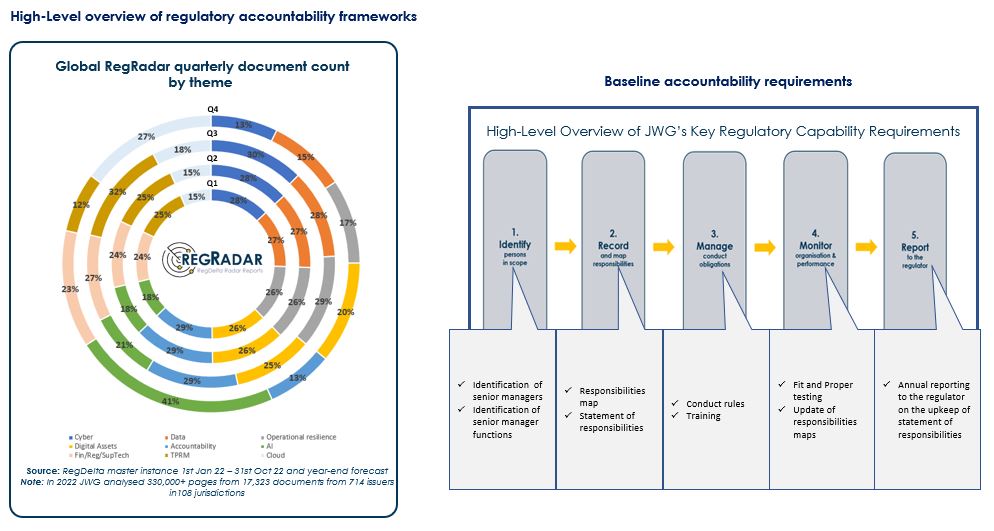

The benefits of RegTech solutions to the EU financial sector have not gone unnoticed. The European Banking Authority (EBA) highlighted the advantages of using RegTech applications in several areas, including risk management, transaction monitoring, compliance and fraud prevention. In addition, the introduction of the Individual Accountability Framework (IAF) will provide an incentive for organizations to comply with financial services laws and regulations.

We have created an accountability control framework, that helps you quickly understand key regulatory texts, down to who it effects, what their responsibilities are, how to manage their responsibilities, how to monitor them, and how to report to the regulator.

With the IAF requiring you to report on all these areas, and show your responsibilities map, it’s imperative that you get ahead of the game to avoid the huge sanctions. We can have you up and running within a matter of weeks, giving you the peace of mind you need to stay on top.

Spreadsheets won’t cut it. You need auditability: trusted content to tie back to the letter of the law, NLP-powered elegant workflow.

RegDelta and RegRadar provide a cost-effective and automated method for businesses to enhance their compliance practices, reduce risk and improve operational efficiency. By leveraging award-winning NLP-assisted regulatory analysts, horizon scanning, and workflow functionality, RegTech solutions can enable organizations to quickly identify potential risks and take corrective measures to prevent costly problems before they occur.

Join us 29 June 2023

At our next RegTech seminar on the 29th of June, leading SMEs will articulate the key regulatory and market reporting compliance challenges precipitated by divergent global policies.

We will be discussing how proven RegTech can be deployed now to help empower public and private sector alignment of interests.

Register for 29 June 2023 virtual pass

Please contact corrina.stokes@jwg-it.eu if you have any questions or would like to work with us.

Useful links:

- Article: Are EU ready for accountability RegTech?

- Solution: RegDelta

- Solution: RegRadar