A spotlight on the business impact of digital regulation

Available on all major podcast platforms, including:

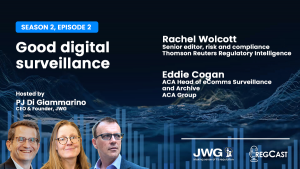

Podcast Episodes

Available on all major podcast platforms, including:

Objective

To stimulate holistic debate over the digital approach to FS sector supervision

Outcome

Contextualise strategic issues and inform strategies for effective development of digital policies and deployment of new technologies in a better, faster, cheaper and safer manner.

Format

Fast paced, key question-driven 30-minute podcasts hosted by JWG with at least 2 expert speakers and subject matter experts

Target regulator & regulated audience

Background

In 2021 the Financial Services sector is undergoing a transition on three fronts:

- Continued digitalization of the infrastructure and demand for digital integrity

- A second decade of post 2008 reforms and demand for more granular controls

- The new post-COVID economic reality of banking in a post Brexit, post Trump world

Key Topics

Conduct & Culture

SM&CR, MiFID III, BoE Future of Finance – new digital rule books

Financial Markets

Trading, market abuse and regulatory reporting

Digital Infrastructure

Cloud, data, new technology and risk controls.

Money Laundering

5MLD transparency obligations and new data rules

Available on all major podcast platforms, including:

Listener Benefits

- Understanding political mandate shifts driven by failures, fines and national agenda

- Contextualising new demands from regulators, and their impact on current practices

- Informing strategies for how to get ahead

Speaker Benefits

- Promote your views/ highlight your institution’s priorities, needs and offerings

- Raise awareness to alternative strategies/ ways of overcoming challenges

- Engage in debate with your peers from around the world

Provisional RegCast 2021 Agendas

In 2021 the Financial Services sector is undergoing a transition on three fronts:

|

Audience |

Title |

Challenges |

New RegTech drivers |

|---|---|---|---|

|

Supervisors, Risk, Surveillance, Data |

Regulatory culture and technology |

The LCF Review |

The FCA response |

|

Transformation, Reg affairs, Data, Technology |

Reg digitisation strategies |

EU digital strategy/ MRER UK BoE data collection/ DRR ADGM unifying framework |

Cloud Data Standards |

|

Innovation, Transformation, Data, Technology |

Post-Covid digital finance |

AI, Cyberattacks, Crypto Digital Currencies CBDC |

De Fi DLT Tokenizing assets |

|

Risk, ESG, Data |

Green reporting and markets |

IFRS requirements Global standards |

TCFD standards DRR |

|

Compliance, Surveillance, Conduct regulators |

Culture audits |

Conduct Culture MAR SM&CR |

Holistic surveillance Voice / eComms post COVID |

|

MLROs, Conduct risk, Data, Technology |

Protecting the digital system (KYC/AML) |

Safe, shareable, cross-border data assets with DLT and homomorphic encryption The future of identifiers and common reference data |

UK economic crime plan AML fines New EU plans for AML Global TechSprint findings & ICO view on PET & AI |

|

Front office, Markets Policy, Technology, Data, Procurement |

Digital Markets post Brexit & MiFID III |

Transparency Best execution Market data Consumer protection Regulatory reporting |

PET Tokenization De Fi |

|

Technology, Data, Procurement, ESG, Conduct regulators |

Leashing BigTech |

Divergence of international cloud standards Direct supervision of CSPs Breaking up Facebook Operational resilience |

Cloud Data Cyber security Operational resilience ESG risk factor K |

|

Front office, Transformation, Compliance, Operations, Technology, Data |

Mapping the regulatory Genome |

Cambridge Centre for Alternative Finance (CCAF) (video here) |

Regulatory obligation tracking Industry collaboration Ecosystems |

|

All |

The regulatory horizon 2021 |

What 28,000 documents tell us about 2021 priorities Top 10 lists |

Priorities Plans RegTech opportunities Collaboration |

|

Front office, Transformation, Compliance, Operations, Technology, Data |

Market abuse post COVID |

New Market Abuse demands Policy impact Fines, threats and reality |

SM&CR MAD/ R |