The recent allegations made against Coinbase and Binance by the US Securities and Exchange Commission (SEC) have cast a spotlight on the compliance challenges faced by the cryptocurrency industry.

However, it is not just the US that is grappling with regulatory issues pertaining to digital assets – a high degree of correlation has been noted between recent international regulatory plans and those unveiled by the UK in February.

As the industry looks to bridge the gap between traditional finance (TradFI) and decentralized finance (DeFi), the adoption of modern technology presents an opportunity to streamline compliance requirements and pave the way for a more regulated and secure ecosystem.

In this article, we shine a spotlight on the challenges for the up and coming asset class if it is to compete in the TradFi arena

Background

This week, the US SEC has alleged Coinbase unlawfully ignored the rules and offered securities unlawfully. This comes the day after filing 13 charges against Binance for even more egregious offences.

SEC Chair Gary Gensler said, “As alleged, Zhao and Binance misled investors about their risk controls and corrupted trading volumes while actively concealing who was operating the platform, the manipulative trading of its affiliated market maker, and even where and with whom investor funds and crypto assets were custodied. They attempted to evade U.S. securities laws by announcing sham controls that they disregarded behind the scenes so that they could keep high-value U.S. customers on their platforms. The public should beware of investing any of their hard-earned assets with or on these unlawful platforms.”

Last month, the board of the International Organization of Securities Commissions (IOSCO) published a consultation report “Policy Recommendations for Crypto and Digital Asset Markets” keeping in terms with the H1 timeline offered by their 2023 workplan.

JWG has published an analysis of HM Treasury’s “Future financial services regulatory regime for cryptoassets” paper in February, concluding that thousands of tweaks to existing rules, such as MiFID II, PRIIPS, MAR are being readied for Crypto assets.

This month, JWG analysts had a look at the International consultation on crypto assets to discover differences and similarities in their approach.

Summary findings

Our analysis shows that regulators have reinforced their message that this asset class needs to manage basic investor protection obligations as much as any other asset class.

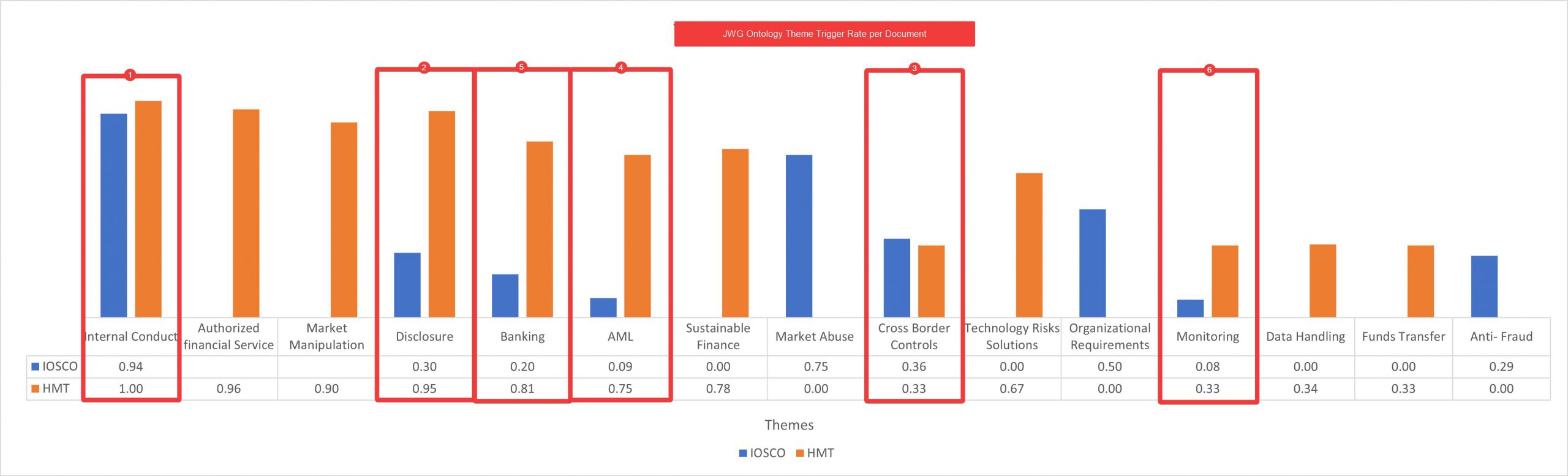

Disclosures, AML, internal conduct, monitoring and payments rules are the areas of current policy which are most aligned between the two documents. In addition, both documents encourage Firms and regulators to establish information-sharing agreements, mutual recognition arrangements, and harmonized regulatory frameworks to facilitate compliant and transparent cross-border trading.

While the slightly longer and more detailed HMT paper goes into more about how the details of the policies which are described in the next section.

The one gap we did spot was Algorithmic stablecoins. HMT maintains that they may be covered under the class of “unbacked crypto assets” which fall within the policy framework. IOSCO does not have an explicit plan for algorithmic stablecoins. However, they do state that some recommendations issued in their recent paper may also extend to stablecoins.

A complete gap analysis will need to wait until the IOSCO consultation report on DeFi emerges in Q3 and will issue final policy recommendations by year-end 2023.

Exhibit 1: JWG analysis of HMT and IOSCO crypto asset recommendations

Thematic analysis

1. Internal Conduct

Importance of identifying and managing conflicts of interest: Interconnectedness among crypto firms amplified by fragile or non-existent risk management, corporate governance failures, and conflicts of interests at individual firms fuels the likelihood of crises. Both papers acknowledge the existence of conflicts of interest where firms or CASPs have multiple roles in a transaction or where they have interests that conflict with those of their clients.

For example, in the collapse of the FTX, it emerged that FTX trading combined with Alameda research company without proper segregation of accounts and duties.

The papers recommend that firms should have effective systems and controls in place to identify and manage conflicts of interest, and that they take steps to prevent or manage such conflicts. The UK regulators according to the February consultation paper are working on legislation to require the regulation of promotions of crypto assets by the FCA to ensure promotions are clear, fair, and not misleading. This legislation will work hand in hand with other legislations like the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 (“MLR”) and Financial Services and Markets Bill 2022 (FS&M Bill).

2. Disclosure

Disclosure requirements are critical for ensuring investor protection: Closely intertwined with our first similarity, both documents emphasize the importance of clear and comprehensive disclosures for investors who are considering investing in crypto assets.

The IOSCO report recommends that regulators consider requiring firms to provide clear information about their assets’ features, risks, and potential returns and similarly, the UK document recommends that firms providing services related to crypto assets should be required to provide clear information about these assets’ features, benefits, and risks.

3. Cross Border Controls

The highly globalized and decentralized nature of crypto asset markets: This presents unique difficulties in identifying and controlling market abuse behaviors, unlike more localized traditional markets. Crypto asset trading venues are accessible worldwide, without a clear geographic nexus between the venue, the crypto asset issuer, and the traders. With numerous tokens and trading venues domiciled in various countries, regulators face the challenge of ensuring compliance and market integrity.

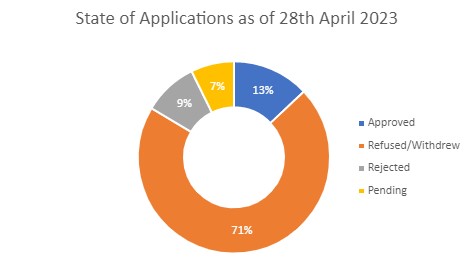

In the UK, FCA has been given the power to take action against market manipulators and distorters operating within and outside their borders. As of the 28th of April 2023, 71% of the crypto firms that submitted applications for registration had been rejected or withdrawn.

Both papers call for the establishment of information-sharing agreements, mutual recognition arrangements, and harmonized regulatory frameworks to facilitate compliant and transparent cross-border trading. IOSCO explored Cross-border supervisory cooperation in their 2022 report through establishment of supervisory colleges formed by regulators across the globe.

4. Anti-Money Laundering

The potential for anonymity and lack of transparency in certain types of transactions highlight the risks of money laundering in the crypto asset industry. Both papers recommend that regulators require CASPs to implement effective anti-money laundering (AML) programs that are tailored to the specific risks associated with crypto assets, including through enhanced customer due diligence procedures, ongoing monitoring of customer activity, and reporting of suspicious transactions.

The UK Market Abuse Regulation (MAR) requires authorized firms to have policies and procedures for countering the risk of market abuse, including detecting, and reporting suspicious transactions.

5. Innovation

Regulatory frameworks must balance innovation with investor protection: The IOSCO report notes that while innovation is an important driver of growth in the crypto-asset market, it must be balanced against investor protection concerns. The report recommends that regulators take a principles-based approach to regulation that allows for flexibility while still ensuring adequate investor protection. Similarly, the UK document recognizes the potential benefits of blockchain technology for financial services but emphasizes the need for clear regulatory frameworks to ensure that these benefits are realized without compromising consumer protection or market integrity.

6. Banking

To facilitate payments and cross-border transactions in a more efficient and cost-effective manner than traditional payment systems: Both papers explore Payments and payment systems, especially stablecoins and CBDCs. These have been earmarked to pass the limitation issues of price volatility, scalability, and usability that have plagued the rest of the crypto assets. Regulators aim to monitor potential use of stablecoins as a form of payment and the regulatory regime that will address issuance and custody activities relating to fiat-backed stablecoins as well as payment-related activities for those fiat-backed stablecoins.

In the UK, the scope of this is expected to cover, at a minimum, GBP and other fiat-backed stablecoins which are issued in the UK. The Bank of England and the Payment Systems Regulator (PSR) will also have a regulatory remit for Digital Settlement Assets (DSAs).

7. Monitoring

Compliance with existing regulations is critical for ensuring a level playing field between traditional financial markets and crypto assets: The UK document notes that compliance with existing financial services regulations is critical for ensuring a level playing field between traditional financial markets and crypto assets. The document recommends that firms providing services related to crypto assets should be subject to the same regulatory requirements as firms providing similar services in traditional financial markets.

Conclusion

These International and UK publications illuminate the global regulators’ mindset on how this asset class fits within the current banking rules.

The Crypto industry has a long way to go to overcome its issues. A renewed interest in complying with these rules will be required to avoid more of these charges and eventual fines or even sentences.

As the importance of these controls becomes clear, the asset class may well wind up being more attractive to firms who already have the infrastructure in place for other asset classes. Digital asset providers beware without RegTech it will be increasingly difficult to stay in this space.

For more information on JWG research & thought leadership activities please contact: Corrina.stokes@jwg-it.eu