The UK Financial Services Regulatory Initiatives Forum released its second major Regulatory Initiatives Grid update of the year and the 7th edition of the Grid overall.

Over three dozen new initiatives have been added to last year’s plan (JWG Grid 6 analysis here) taking into account the summer update which flagged the significance of Financial Services and Markets Act (FSMA)’s Royal Assent.

JWG RegRadars are primed and ready. Join us for JWG’s 7 February 2024 at our 8th annual RegTech conference as we ask experts to zoom in on trading initiatives.

Register here for 7 February 2024

UK planning background

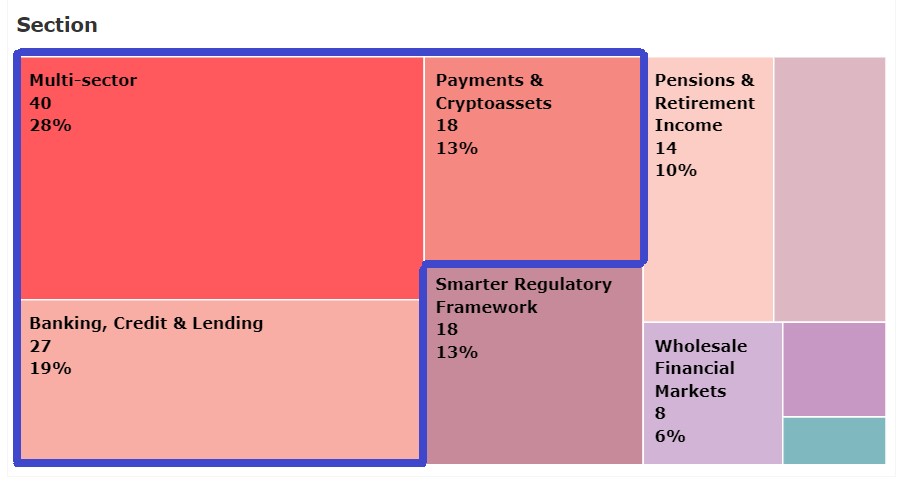

Despite 37 initiatives completed or stopped the total number of regulatory initiatives remained on par with the previous grid (143), this is in part thanks to the newly introduced ‘Smarter Regulatory Framework’ (SRF) section and a continued inflow of new initiatives.

The majority of completed initiatives (68%) came just from 3 sectors “banking, credit and lending”, “multi-sector” and “payments and cryptoassets” which remained the 3 most popular sectors.

A new “SRF” section has been added based on the feedback received by regulators. SRF is a framework to repeal retained EU law (REUL) relating to financial services and consists of 13% of the total initiatives.

New initiatives comprise a third of total initiatives with 33 (vs 41 in Grid 6), majority of which originate in the already mentioned above “multi-sector”, “banking, credit and lending” and “payment services and cryptoassets” categories.

Source: FCA

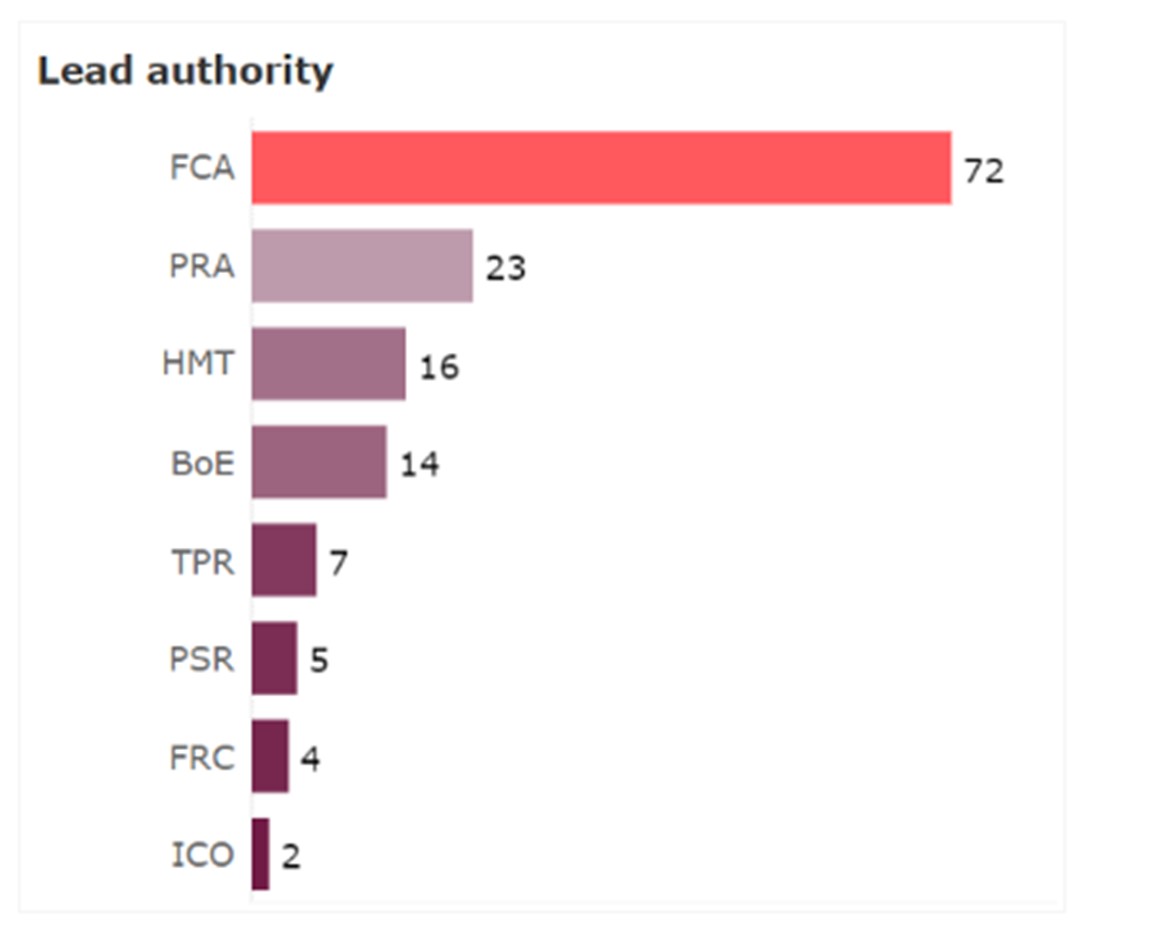

Overall, FCA has remained the leading authority with 72 initiatives in total. FCA was also a leader in high impact areas with 16 individual and shared initiatives, with PRA taking second in both categories with 23 and 11 respectively.

November 2023 Grid update analysis

Following the same methodology taken in our previous analysis, we will now go over the three key sections (highlighted blue in the image below) and explore their new initiatives and timing updates.

Source: FCA

Multi-sector

Remained the densest section with 40 total initiatives and second number of new initiatives (only behind SRF)

Lead regulator: FCA

Total initiatives: 40[1] (Remained on par with the February report)

New initiatives: 7 (11)

Timing update: 8 (8)

New initiatives added to this section include:

- Ban on cold calling for consumer financial services and products

- Guidance on biometric data and biometric technologies

- Post-implementation review of the Guidance for firms on the fair treatment of vulnerable customers

- Complaints reporting review

- Task Force on Climate-related Financial Disclosures (TCFD) reporting requirements

- Stewardship review and Code consultation

- System-Wide Exploratory Scenario Exercise (SWES)

Areas that received a timing update are:

- Regulatory framework for approval of financial promotions

- Consultation on restoring trust in audit and corporate governance

- Compensation Framework Review

- Expansion of the dormant assets scheme – second phase

- Complaints reporting review

- Implementing ISSB disclosure standards into FCA listing or transparency rules

- Diversity and Inclusion in Financial Services

- LIBOR Transition (H)*

Banking, credit & lending

The second densest section received the highest number of timing updates and a total of 27 initiatives.

Lead regulator: PRA

Total initiatives: 27 (30 in the previous report)

New initiatives: 4 (10)

Timing update: 12 (10)

New initiatives added to this section include:

- Ban on cold calling for consumer financial services and products

- Review of Debt Advice Rules (CONC 8)

- Evaluation of the persistent debt intervention

- Amending the Threshold Conditions

Areas that received a timing update are:

- Credit Information Market Study Final Report

- Tailored Support Guidance (TSG) – Consultation Paper

- Amendments to the Credit Unions Act

- Regulation of Buy Now Pay Later (H)

- Improving depositor outcomes

- A strong and simple prudential framework for non-systemic banks and building societies – Capital requirements for Simpler Regime Firms (H)

- Banking Data Review

- Revisions to PRA109 (Operational Continuity in Resolution Reporting)

- Reforming the ring-fencing regime for banks

- Non-performing exposures capital deduction Consultation Paper

- Implementation of the remaining Basel III banking standards (Basel 3.1) (H)

- Supervisory Statement on model risk management principles for banks

Payment Services & Cryptoassets

The third most popular section continues to remain one of the key regulatory priorities with the 3rd highest number of new initiatives.

Lead regulator: PSR

Total initiatives: 18 (22 in the previous report)

New initiatives: 4 (10)

Timing update: 4 (3)

New initiatives added to this section include:

- Ensuring continuity of critical clearing services: the Bank of England’s approach to discretionary payments by central counterparties

- Allowing a risk-based approach to payments

- Payment services contract termination rule changes

- Managing the failure of systemic digital settlement asset firms

Areas that received a timing update are:

- Supervisory approach to wholesale cash (H)

- Changes to safeguarding requirements for payments and e-money institutions

- Consultation response on future financial services regulatory regime for cryptoassets (H)

- Consultations on rules for stablecoin regime

Conclusion and Next Steps

With FSMA receiving Royal Assent, there is little doubt that “SRF” will continue to remain one of the key priorities of the upcoming years along with “multi-sector”, “banking, credit and lending” and “payment services and cryptoassets” plans.

Unless there are any unforeseen significant changes, the Financial Services Regulatory Initiatives Forum expects to continue to release updates to the Grid on the biannual schedule.

Let us know if your business needs help aligning your RegRadar and please join us at our 7 February annual RegTech conference which will touch upon many of these efforts.

This event is the ‘must go’ for many senior decision makers as they help shape the future of the of this rapidly maturing RegTech sector.

We look forward to having you at the physical table!

Register here for 7 February 2024

* H = High impact according to regulators; actual work effort may vary depending on a firm’s infrastructure

[1] It seems in fact there are 39 total initiatives for Multi-sector as “Overseas Persons Exclusion” is listed under completed items on the PDF despite being categorised in the initiatives grid Excel file as ongoing