16 May 2017 signalled the end of the European Commission’s public consultation period on the operations of the European Supervisory Authorities. The purpose of the outreach was to gather market evidence on the progress of the ESAs towards their objectives for short, medium and long-term stability and the effectiveness of the financial system.

JWG brought together leading buy-side, sell-side and technology vendors in our RegTech Special Interest Group for Reporting and Reference Data to inform the EC of how best to construct a clear path moving forward, and to identify where effectiveness and efficiency could be strengthened and improved.

Why is the reporting mountain so hard to climb?

Many of the ESAs’ work programmes over the last seven years have defined the promotion of supervisory convergence as a number one priority, categorised by a series of objectives that cover all aspects of financial services. The challenge is that there is no way to address the thematic issues identified by the European Commission, as evidenced in the realm of regulatory reporting.

When so much of today’s information is computer generated, the language and method of data collection used by the ESAs needs to evolve to meet market practice. To increase the quality of decisions being made within European reporting at a reduced cost, ESAs need to be empowered with a core reporting capability which is comprised of several supervisory tools.

Below we outline the problems faced and the objectives required for best practice in promoting a common supervisory culture and the fostering of supervisory convergence, with a specified focus on the drafting and oversight of regulatory reporting obligations.

- Lack of a common rulebook

Perhaps the biggest issue to overcome is that the cumbersome legal texts used to describe regimes across the regulatory landscape obligate market actors to serve up varying – yet very similar – interpretations of the same underlying requirement.

The best example of the need to develop a common, converged regulatory rulebook is in the realm of OTC derivatives, where certain trade or transactions need to be reported as much as three or four times under different regimes. These requirements create difficulty for technologists to follow the relevant obligations and to understand the implications of them.

- Missing a unified framework for information exchange

More worryingly, different reporting regimes impose different information exchange requirements – one regime may require reports to be submitted via an ARM, whilst others ask for trade repositories to be utilised. The lack of a common dictionary creates a further muddying of the water; to understand what is being asked, the industry needs to have definitions of the components.

Rule makers have, at times, seemed reticent to reuse the infrastructure at their disposal with the reason that the drivers are too different and, thus, the outcomes need to be unique. This results in an imbalance in the ratio between determining what is being asked for and the time and effort invested to find what is required for compliance. According to our working groups, the industry spends 90% of their time working the ‘what’ and are left with only 10% for the ‘how’. The ESAs have the power to reverse this and optimise how obligations can be fulfilled.

By aligning consistency across legislative text, the industry will be able to mobilise their compliance efforts by devoting more time to common solutions and quality control and less to the siloed investment in individual regulatory efforts. By focusing on the common needs of thousands of industry participants early in the reporting cycle, utilities can have more of an impact and ease the burden.

- Inability to cross-reference data terms in a common dictionary

To review these reporting obligations together, some disconnects in the ESAs’ approaches would need to be remediated. An example of this can be evidenced between the ECB’s BIRD database for AnaCredit reporting and the market reporting required by ESMA. This data shares many of the same attributes as the markets reporting for ESMA’s EMIR, MiFIR and SFTR, EBA’s MMSR and ACER’s REMIT. The problem is the dictionary is being compiled without input from the ESAs, resulting in added complication as the industry attempts to reconcile their view of the market with that of the conduct oversight communities.

The underlying issue is that much of what is being asked for is already available – the ESAs are receiving the same type of information, often with only slight modification of the way the data is conveyed.

Collection of commonly understood, high-quality data does not lend itself to leaving grey areas, and begins to address the infrastructural deficiencies that have been introduced into the system by the way regulation is conveyed – the technical mechanism (e.g., paper legislation versus electronic, machine-readable form).

We believe there is a strong business case for more being done at the centre to decipher obligations early in the implementation process. This would align the market’s understanding of what needs to be done, how to do it and who needs to be involved earlier in the process.

- Confusing roadmap from an implementation point of view

One large area of reporting divergence can be seen in the inconsistency of timelines; recently evidenced by the delay in EMIR implementation that led to the postponement of the deadline for inclusion for reports.

The operations and technology communities would welcome a common timeline and testing procedure for all changes to reporting frameworks – the problem is, for those due on the not-so-distant horizon, time is running out. Publishing advice does not induce the detailed required; huge requirements are being asked for in monolithic chunks. By breaking down the obligations into bite-sized, easy-to-swallow pieces, we can avoid regulatory indigestion altogether.

- Ownership of the reporting toolbox

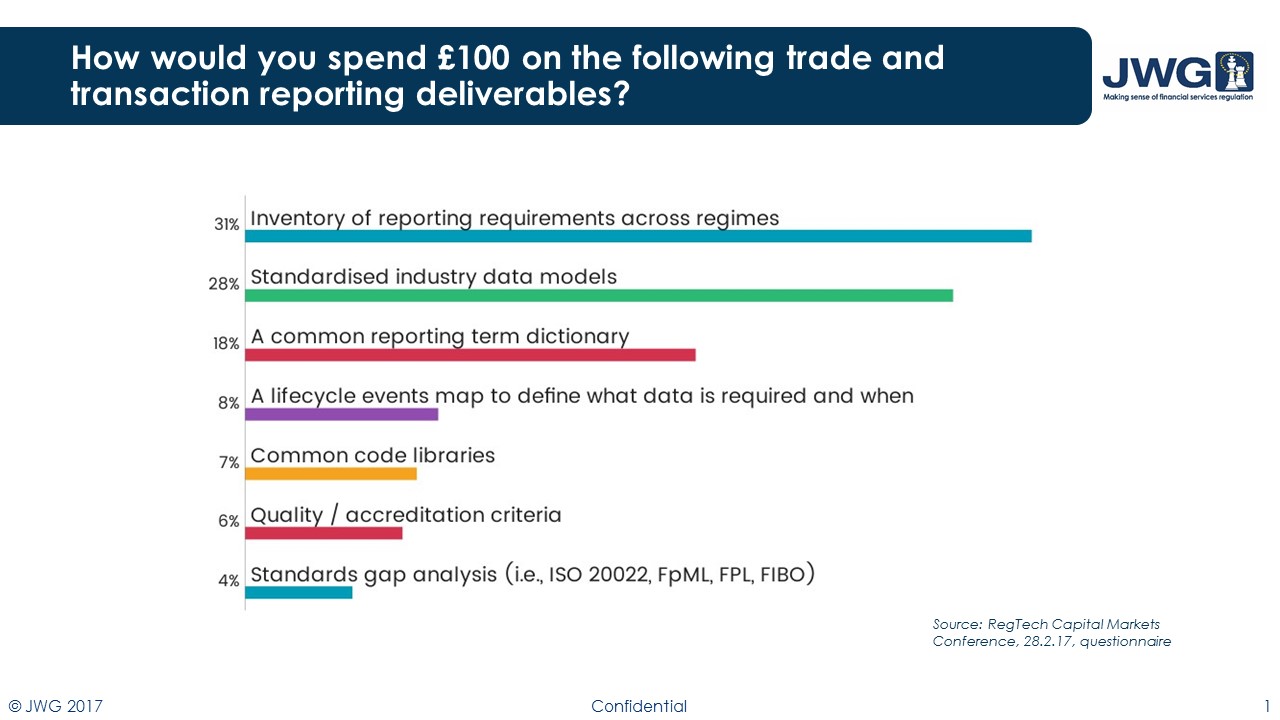

Finally, more could be done at the centre to decipher the intention of politicians. While we applaud the efforts of the ESAs to follow the instruction of the EC, there is a set of tools missing that could guide us on our quest for better, faster and cheaper reporting. As shown in Figure 1, the industry doesn’t have the RegTech artefacts in place for this ascent.

Figure 1

In our response, we have listed the tools that the industry believes to be the most relevant to the ESAs’ purposes. We will be working on practical examples and creating a best practice guide at our next meeting of reporting SMEs on 20 June.

The path moving forward

JWG’s full response is now under evaluation by the European Commission. In the interim, the Reporting and Reference Data SIG will reconvene to determine the next course of action and how we can begin to construct a framework for regulatory reporting by utilising a toolbox of industry artefacts.

We are keen to hear from market participants within the reporting space to continue building on the valuable work already put forward from our established member base. Please contact RRDS@jwg-it.eu if you would like to receive a copy of the response and to get involved.