A top-tier European bank has successfully implemented digital regulatory reporting (DRR) technology to comply with the U.S. Commodity Futures Trading Commission’s (CFTC) amended swap data reporting rules, a key milestone in a years-long industry effort to streamline often complex obligations.

BNP Paribas yesterday announced it used DRR in a real-world, production-level environment, with a successful test submission of data to the Depository Trust & Clearing Corporation’s (DTCC) swap data repository (SDR). Paribas and other top-tier firms will complete their CFTC rewrite implementation and go live with DRR on December 5.

“We’re pleased to be the first to use the DRR in a production-level environment with real data, enabling us to generate automatically a report for submission to the DTCC’s CFTC SDR testing simulator. We’re now in a position to implement the DRR for the CFTC rewrite on December 5, and subsequent changes to reporting rules expected in Europe and Asia-Pacific,” said Harry McAllister, an information architect at BNP Paribas in London.

Other top-tier banks will use DRR technology which is built up from the International Swaps and Derivatives Association’s (ISDA) Common Domain Model (CDM). The CDM, developed in 2018 by London-based REGnosys, is a blueprint for how derivatives are traded and managed across the trade lifecycle. It facilitates the expression of reporting rules as machine-executable code which then transmit CFTC swap data reports to a repository.

The CFTC rewrite DRR is a first step that will eventually roll out to other derivatives reporting regimes such as the European Market Infrastructure Regulation ( EMIR) refit, said Leo Labeis, REGnosys’ chief executive in London.

“Ultimately, this year’s cross-industry effort to tackle the U.S. regime will have a major impact on future regulatory reporting practices. Where previous collaborative ventures have run against the lack of effective tools, DRR equips the sector with the necessary capabilities to work together in open source. The CFTC rewrite is the first and crucial implementation of this new approach. Firms which invest now will have a strong foundation for subsequent amendments, including EMIR Refit and several Asia-Pacific regimes coming in 2024 and beyond,” Labeis said.

ISDA estimates that 70% of the coded CFTC rules are expected to transfer directly to the DRR for EMIR, while as much as 90% of the combined coded U.S. and European rules may transfer to DRR used for Asia-Pacific regimes.

Five years in the making

Digital regulatory reporting development began five years ago with a techsprint sponsored by UK regulators. After several pilots, UK regulators shelved the project saying the technology was not advanced or widely used enough to take forward the work.

The work was instead taken up by an industry group that first agreed on a “mutual” interpretation of the new CFTC reporting rules and then conducted further work, using the CDM, to translate those rules into code to enable reporting into the trade repository.

“Now there exists a coded version of the CFTC rewrite that any firm can go and use. It’s a proven body of codified rules that will quickly expand to cover more reporting regimes,” Labeis said.

The European Commission and the European Securities and Markets Authority (ESMA) recently completed their own EMIR DRR pilot this year. The Commission is seeking to apply DRR or machine-readable and executable reporting (MRER) more broadly as regulations come up for review.

“We now have the European Commission (DG-FISMA) showing that this is doable and recommending that regulators do it. It could trigger a multi-year process for the [European supervisory authorities] to develop the technology,” Labeis said.

Regulators who are not engaged with DRR may find themselves left behind or even driving industry toward less effective solutions.

“By committing to a digital approach to regulatory reporting Europe has thrown down the gauntlet to global regulators and opened the doors to true industry collaboration. With market turmoil unseen since 2008, the momentum for better transparency is growing. Add to that long-planned reporting upgrades to derivatives (EMIR Refit), equities ( MiFID II), digital assets ( MiCA) and ESG, technocrats who are leaning back could well find themselves far behind by 2024. The time for experimentation is over. Business cases and plans for new collaborative models, standards, infrastructure, and plumbing is required now,” said PJ Di Giammarino, chief executive at regulatory think-tank JWG.

This article was produced by Thomson Reuters Accelus Regulatory Intelligence on 03 November 2022

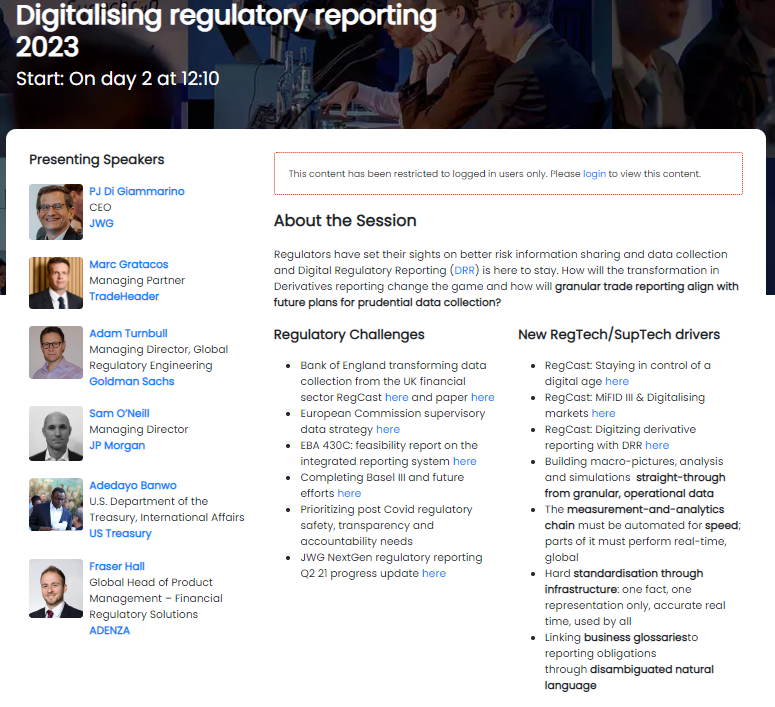

Want to know more? Come along to our 7th annual RegTech conference on November 9-10 to look ahead to the 2023 agenda.