Digital regulatory reporting (DRR) music has upped tempo in 2022:

- Internationally, the Financial Stability Board (FSB)has become the new home for reporting requirements and is poised to launch its 2023 workplan

- In the US, the derivatives sector is enjoying the benefits for CFTC rewrite reporting which start next month before deploying DRR code across the globe

- Europe is pushing ahead with an aggressive programme to modernise and simplify ALL reporting.

This is music to the ears of operations professionals as current reporting systems will not scale to meet the needs of an agile, data driven economy. Could 2023 be the year that real plans are put in place to transform regulatory reporting?

Listen in to our annual conference on the 2023 RegTech agenda now on demand here

US CFTC rewrite + global derivatives update

BNP Paribas announced this month that it used DRR in a real-world, production-level environment, with a successful test submission of data to the Depository Trust & Clearing Corporation’s (DTCC) swap data repository (SDR). Paribas and other top-tier firms will complete their CFTC rewrite implementation and go live with DRR on December 5.

“We’re pleased to be the first to use the DRR in a production-level environment with real data, enabling us to generate automatically a report for submission to the DTCC’s CFTC SDR testing simulator. We’re now in a position to implement the DRR for the CFTC rewrite on December 5, and subsequent changes to reporting rules expected in Europe and Asia-Pacific,” said Harry McAllister, an information architect at BNP Paribas in London.

This is a big milestone, as the global field standards have now been expressed in the industry’s economic language (via a common domain model) to a single regulator’s technical specifications.

Not only is this mutualised interpretation is a huge efficiency gain, it puts firms and their software providers on the same page and able to adapt to regulatory changes. For a full statement of benefits see here.

FSB Update

As we learned at our conference, the FSB Standing Committee on Standards Implementation (SCSI) will be looking to shift the reporting paradigm next year.

COVID and recent market shocks (e.g., LME, FTX) have highlighted a need to get a better handle on risk. The FSB has asked for a report on exit strategies to support COVID 19 recovery which will be delivered later this month. The interim report in July majored on the role of international standards noting that the “FSB and SSBs are working to draw lessons about the motivation, timing and effects of measures that go beyond the flexibility embedded in international standards.”

The FSB is also exploring options to improve the adoption of the LEI, cross-border payments and cyber incident reporting which could further promote the adoption of the DRR approach.

Europe / UK update

As Thomson Reuters has reported here, this month “The European Commission has pushed ahead with digital regulatory reporting — which it views as a central workstream in its overall agenda to make financial services fit for the digital age — while UK regulators have sidelined similar initiatives”

The Commission is taking a deliberate approach to testing technology and frameworks for delivering machine-readable and executable reporting (MRER), also known as digital regulatory reporting (DRR).

It wants a sustainable solution that ultimately reaps cost benefits and outweighs upfront costs.

“The overall objective here is of course to modernise and simplify ESAs’ reporting and ensure that we have the reporting system that delivers the necessary data that authorities actually need to fulfil the supervisory obligation, while at the same time minimising the aggregate reporting burden on all parties.”

Paulina Dejmek Hack, Director DG FISMA

This is music to the ears of operations professionals who note that the recent workshop on machine-readable and executable reporting (MRER) here validates both the technical approach and the business case for DRR.

Most importantly, EU regulators are committing to play their part in what needs to be public/private sector collaboration. In essence, Europe has thrown down the gauntlet to global regulators and opened the doors to true industry collaboration.

JWG’s Digital Reporting Task Force

JWG has been leading a Digital Reporting Task Force (DRTF) to propose a path forwards for over a year.

DRR Fast facts

- Since 2017, the FCA, Bank of England, European Commission and other regulators have been working with the industry to pioneering Digital Regulatory Reporting (DRR)

- The DRR approach codifies the derivation logic applied to business transactions (i.e., operational data) which is understood to be sufficient for supervisory data points

- JWG Is proud to have steered the Derivatives DRR programme to a successful conclusion this year in time to scale North American, Japan, Australia, Singapore, Europe, UK and Hong Kong deliveries to a global standard in 2024

- JWG’s Digital Regulatory Reporting Task Force (DRTF) has framed the Digital Reporting problem statement, target state gaps, proposed approach

Last month, after 6 meetings examining reporting problem statements from a variety of angles we concluded in our senior messaging meeting that the time for experimentation is over. Business cases and plans for new collaborative models, standards, infrastructure and plumbing is required now.

DRTF Problem statement: Current regulatory reporting systems will not scale to meet the needs of a digital, agile, data-driven economy in a cost-effective manner without public/ private sector collaboration

DRTF has identified many current challenges:

- High cost, and high cost of transition but no framework for valuing data (as capital)

- Data disconnected from economic activity with insufficiently rich reference data

- Ingesting massive transactional datasets which are disconnected from aggregate balance sheet risk

- Granular, complex, intensive risk analysis without an agreed semantic approach

- Fluid regulatory demands (e.g., ESG, Crypto) and no foundation to develop better practices.

We are far from the Ideal DRR target state:

- Shared Shared public/private objectives, language and value

- Endorsed standards for data and identifiers

- Global collaboration across the reporting ecosystems

- Realistic transition plans

Today’s gap, therefore, and the challenge for DRR 2023 is to define a shared target state vision for the platform, business case and funding model to incentivise many different communities to free up their scarce expert resource to move to digital reporting models.

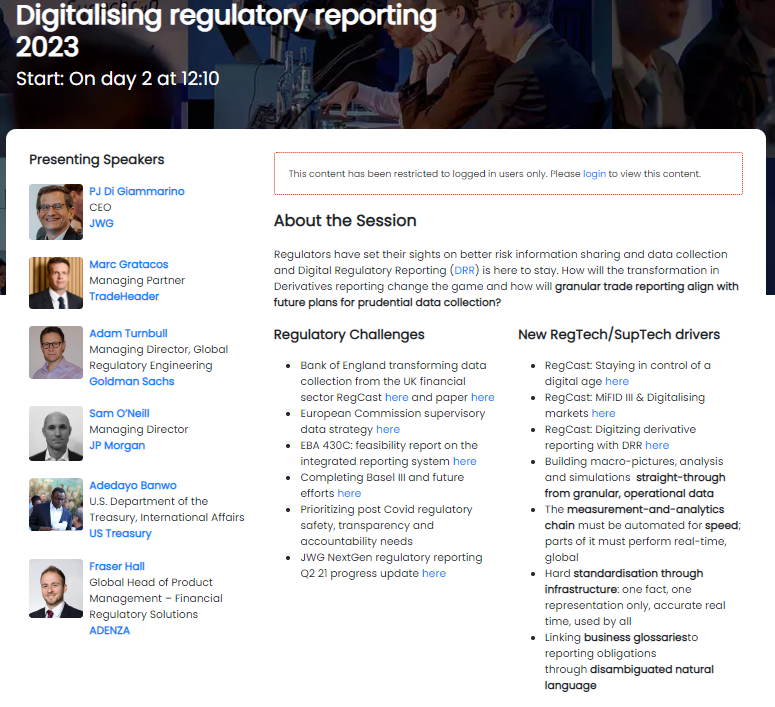

Want to know more? Register to listen to Goldman Sachs, JP Morgan and other SMEs for our 7th annual RegTech conference now available on-demand.