Public and private sectors are finding a path through the jungle of compliance to safe code. New public/private coalitions, new mandates and new ways of working are required.

In many ways it feels like 12 years since we started talking about the need for RegTech, it is now more a subset of the Banking Tech conversation than ever before. Is it time to unite Banking Tech and RegTech tribes?

JWG has been exploring what RegTech success looks like in the run-up to our 22 March global, virtual, Trading compliance seminar.

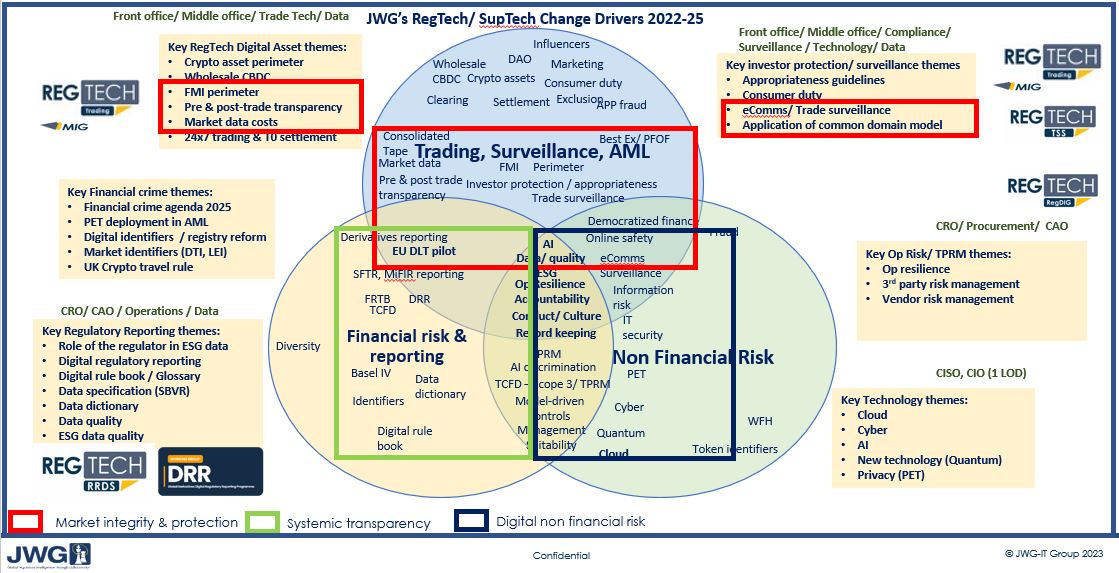

RegTech 2023 Radars

New political and economic instability has provided impetus to controlling fraud, ensuring consumer duties are met and creating a holistic picture of the system including ‘how’ operations are conducted.

At the same time, FinTech and digital assets have become real and new opportunities for market share and tax revenue have sparked a race for FinTech and Digital Asset hubs.

This means politicians are demanding more from their regulators who can justify spending money and time writing detailed rules and issuing fines if they are not observed.

Compliance is now operating in a less siloed world. Our radars show much more systemic, much more fragmented and complicated obligations.

This makes the job of aligning to common standards more complicated and the number of different stakeholders involved much more complicated.

To help find effective pathways through the jungle of compliance to safe code, JWG will focus 2023 plans on the interconnections and dependencies between publica and private sector efforts to enhance market integrity and protection, improve systemic transparency and remediate digital non-financial risks which threaten its safety.

For a more detailed perspective on JWG’s Radar, please see our Beacon here or RegCast here.

Large firms are leveraging RegTech to create common, DLT-enabled models of their compliance obligations to power model-driven controls. It has also upped the ante for regulators to realign their innovation programmes with the fast-moving requirements of global rule book rewrites.

New mandates, new ways of working

Industry has long craved the ‘safety of the herd’ for compliance. One way these herds form is for an enterprising shepherd to convince the firms to buy her software. Through user groups, she can align on the decisions made and stay one step ahead of the regulator and market.

Another way to form a herd is to go to associations and standards bodies. These have professional facilitation services that capture the decisions and codify them through formal governance processes.

Both models have pros and cons but ultimately require alignment in some form between regulators, regulated and their suppliers,

The challenge is that neither process scales particularly well. The RegTech community has been frustrated for years by a lack of mechanism to “bless the code”.

The biggest public/ private leadership challenge this year is how to get to a point where the public sector is confident enough to take the initiative to mandate something to happen.

Once they do, buy-side, sell-side large and small firms will have the incentive to actually collaborate in a way that will drive improvement quickly.

Public & Private Sector Pathfinding and tooling

JWG’s experience with Digital Regulatory Reporting (DRR) has shown that collaboration across firms on a common technical platform is no easy task.

The code will neither be written on its own nor maintain itself. To be fit for purpose it must be governed properly.

The public/private structures in place today will require new ways of working. It may be counterintuitive, but in order to make compliance ultimately simpler, the industry will need to get lots more detail at a practicable level for practitioners.

The more obligations involved, the greater the number of actors and it becomes exponentially more complicated to get results.

At the same time, unless the exercise is sufficiently detailed, the exercise will not produce the value required to justify the investment of expensive resource from the top firms who must all feel they have aligned incentive structures.

All this means that technology is required to model the obligations and agree how the regulatory obligations apply. Excel spreadsheets and pdfs won’t cut it, the interpretation needs to be coded and ideally that code needs to be able to be adopted in some way by the institutions contributing to it.

As JWG enters its 17th year of providing a safe space for collaboration we see that now more than ever the ‘Technology’, ‘Data’ and ‘Controls’ tribes need to join forces with ‘Risk and Compliance’. Key to joining forces is common interpretation of the regulatory obligations maps onto the operations of the business.

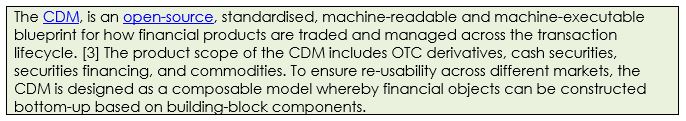

The industry now has the opportunity to think about how we use the newly standardized Common Domain Model (CDM) to help manage risk, and to be able to end to deploy common risk typologies, code and the test data to mitigate the risks.

By following this path, we could extend business efforts into the middle and back office,

For the front office and financial risk communities this means taking collateral, settlement and post trade processes and linking them to their compliance obligations that can be mapped to the core systems that manage these functions.

In the non-financial risk space, emerging operational risk standards can be used to define what good looks like, not only from an operational perspective, but also from a compliance perspective.

Building RegTech Coalitions

Recognizing the size of the challenge and commensurate prize for getting it right means bigger, bolder RegTech coalitions

There is unlikely to be a single, joined up starting point, but rather, focused efforts across multiple regulatory fronts. We might find that over time, the more operational functions will finally get adopted by the front office only quite close to implementation time.

For the non-financial risk community, with pressing needs in Operational Resilience, Cyber, Technology risk there are immediate imperatives for regulators and industry at the same time.

For the regulatory transparency, the risk and data communities could usefully spearhead a cross regulatory reporting initiative to satisfy Basel IV’s thirst for balance sheet data that reconciles to market information, trade and transaction reporting and ESG data.

For trading, surveillance and protection of the system, the AML/CFT and Trade surveillance communities could leverage the impetus for new economic crime plans and market abuse initiatives to start codifying the risk framework.

In a nutshell, a coalition-based approach to gathering stakeholders who manage the current operations can create intelligent, common code that has a spiritual home and caretakers.

Conclusion & Outlook

12 years after our first issue of RegTech magazine was published in conjunction with Banking Technology magazine it feels a bit like we are headed back to the future.

As we discussed with our esteemed colleague, Gavin Stuart has said in the inaugural RegCast for season 3, ultimately RegTech efforts will be driven by practitioners at the level of detail needed to prove their day jobs are being performed to the required specification.

This will require a consistent map of exactly what’s going on at the granular level in order to be meaningful to institutions of many shapes and sizes.

2023 will be about framing RegTech coalitions around models that can be integral to the core banking platforms, FinTech and digital assets.

To make this happen we need coalitions of regulators, regulated and their suppliers that make the financial system safe.

Join us for our next global, virtual, NextGen trading compliance seminar on 22 March to hear from global experts about the regulatory changes ahead and how you can act now to mitigate your risks.