Winning the ESG data Marathon in 2023

With the ever-increasing focus on ESG transparency from regulators and clients, firms are racing to meet the requirements needed to make their mark in the global marketplace.

This race requires tens of thousands of market participants to produce data according to different standards. However, with a proper plan in place, firms can ensure they meet boards’ objectives and supervisors’ compliance criteria.

JWG’s exclusive research lays out the challenges for our 29 June virtual seminar which will use our RegRadar to get race advice from the experts.

ESG data overview

As we learnt from our 22 March Seminar, the transparency dream of last generation regulation has been turned into a complex nightmare due to data practices, inconsistent approaches and incoherent reporting.

Internationally, standards bodies having been producing ESG frameworks faster than they can be harmonised, globally, the world is aligning with the UN Sustainable Development Goals and Emissions Scope 1-3[i], the EU is looking at the next wave of non-financial risk[ii] and harmonising its numerous sustainability-focused regulations, and the UK, US and Asia are moving in this space too.

However, as the FCA has admonished ESG benchmark CEOs this month, the quality of disclosures made by a sample of UK benchmark administrators. In general, this was poor[iii]. Similar feedback is expected from the EU in Q2.

Marathon data strategies

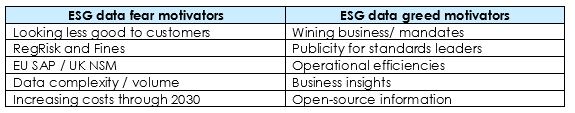

Gone are the days when firms could bury their head in the sand and pretend that the ESG firing gun hadn’t started. The drive for ESG transparency presents both a threat and an immense opportunity for the financial sector.

Now is the period of grace to get it wrong, but with market and oversight pressures building, that is closing fast. Drivers to adopt ESG measures are not solely regulator driven, but also directly coming from public demand.

Regulatory race stewards are paying particular attention to how firms implement new EU SFDR[iv] and CSRD rules which apply to all industries. They expect participants to have their race maps laid out with concrete objectives for compliance by 2030.

Race incentives

More and more, firms are becoming cognizant of investor interest in more sustainable products and services. Studies (particularly of note Orlitzky, Schmidt and Rynes, 2003, Margolis, Elfenbein and Walsh, 2009[[i] and Wang, Dou and Jia, 2016)[ii] are showing a positive correlation between Corporate Social Responsibility and financial performance.

There is large upside in getting across the multiplying landscape of ESG reporting regimes at the front of the pack. However, as US regulators point out with an early wave of race tickets (see below) success requires long term strategy, careful planning and preparation to ensure you don’t become an easy target at the back.

2023 ESG data targets by jurisdiction

In 2023 we are seeing concrete plans setting and these are only increasing in both scope and application, as more firms and corporates are set to be held to the standards already issued to large financial institutions.

This means senior management’s attention to rules, standards and the accompanying scrutiny are required to establish operational approaches for vast amounts of data that is not kept in house today.

This will have large impacts across the supply chain, as products are classified and governance strategies become compliance-ready.

The EU’s SFDR’s first mandatory reporting deadline coming up in June[iii], or risk the penalties that are likely to start coming thick and fast in the coming years.

International Guidelines

Internationally, there is again significant focus on the E in ESG. The IFRS have been introducing scope 1-3 disclosure standards on emissions[iv] reporting covering:

- Scope 1:Direct emissions generated by the company

- Scope 2:Indirect emissions from immediate vendors or utilities that supply the company

- Scope 3:All indirect emissions throughout the value chain worldwide

Initial targets aim at 2023 implementation, although there is some expectation that scope 3 disclosures will slip. These will require more thought to how upstream and downstream reporting including everything from employee commuting and fuel and energy to the use of sold products and investments are done. However, with some countries such as Germany already laying out plans, expectations may already be set.

The Basel Committee released in June last year their Principles for the effective management and supervision of climate-related financial risks[v]. It outlines 18 principles covering corporate governance, internal controls, risk assessment, management and reporting, aiming to achieve a common baseline on climate related risk for internationally active banks and supervisors in line with the UN SDG[vi]s. The key ones of note for most current regulations and standards are:

- 12: Responsible consumption and production

- 13: Climate action

Between them, they contain 16 targets, nearly 50 UN publications and 3000+ actions[[vii]].

The International Sustainability Standards Board (ISSB) are finalising their standards[viii]. The understanding it that they will release two frameworks by the end of June, with the first corporate reports in 2025.

EU

One of the most prolific regulators, it’s no surprise that the EU is ahead of the game when it comes to ESG. As with most of the world, there is a more well established set of rules for the E, with the Taxonomy Regulation already underway[ix]. The regulation aims to bring firms in line with European environmental targets through disclosures of environmental impact of economic activity. From 1 January it became mandatory to report on Taxonomy alignment, within the 6 criteria:

- Contribution to mitigating climate change

- Ability to adapt to climate change

- Alignment with circular economy principles

- Impact on pollution

- Effect on water and their impact on biodiversity

Although the EU Ecolabel has been established since 1992 (last year celebrating 30 years) , the application for retail financial products was strongly in focus in 2022, with projects underway to establish the criteria for retail financial products[x].

Level 1 requirements of SFDR have been applicable since March 2021 but the start of 2023 saw the introduction of Level 2 becoming mandatory. The RTS on methodology began to apply in January this year[xi].

The regulation targets the oft discussed issue of greenwashing, the misleading of investors through environmental claims, by requiring product and entity level disclosures. Firms in scope are required to collect relevant data from portfolio companies and other entities and implement the reporting templates, the Principle Adverse Impact indicators (with heavy MiFID II suitability requirements impact leading to customer repapering, costly licensing and significant reference data challenges), in addition to aligning reporting processing with the content and methodologies laid out by the regulation.

2023 sees the first time firms will be required to report on the principle adverse impacts (PAIs)[xii], in line with the delayed RTS, the deadline 30 June fast approaching. This presents a huge risk of looking bad for getting it wrong and high reward for getting it right as customers seek sustainable products. Clarifications on the RTS have been provided on the following additional areas:

- Sustainability indicators

- Financial product disclosures

- Direct and indirect investments

- Taxonomy-related financial product disclosures

- Do not significantly harm (DNSH) disclosures

- Disclosures for products with investment options

The new CSRD disclosure requirements[xiii] will progressively begin applying from 2024 onwards (until 2028) applying to all large companies and almost all SMEs, including non EU parent companies with subsidiaries or large branches within the EU.

This is, unsurprisingly, a huge concern for many firms with EU elements, as extraterritoriality rules increase the complexity of what good looks like. CSRD targets alignment with the Disclosure and Taxonomy Regulations with more detailed sustainability reporting standards. One of the key elements of the adopted CSRD requirements is that of double materiality, that it is not just sustainability-related impacts on the company that have to be accounted for as material, but also the impacts of the company on the environment and other ESG-related areas. This is a huge challenge for achieving “what good looks like” when the complexity of the double materiality requirement is so immense.

Within the EU, Germany is an interesting note, as from January this year, they have brought in the Supply Chain Due Diligence Act[xiv]. In many ways this enacts the IFRS Scope 3 value chain standards (see below). The act requires firms to monitor and perform due diligence on their supply chain for sustainability impact. Fines could be up to 2% of a firm’s annual turnover, and potentially a barrier to entry is the firm or their supply chain are not meeting the required standards.

In France, the AMF is proposing the introduction of minimum environmental requirements for financial products to meet SFDR regulations[xv], avoiding investors misunderstanding the implications for sustainability as a result of the Article 8 and 9 categorisation. The proposal suggests minimum environmental criteria, a percentage of Article 9 funds aligning with the Taxonomy Regulation, a binding ESG approach in investment decision making, and funds should exclude fossil fuel activities that are not Taxonomy-aligned.

UK

The UK is in the thick of FSB’s TFCD alignment[xvi], which echoes a similar story across in Canada. TFCD recommends disclosures for four key areas: Governance, Strategy, Risk Management and Metrics and Targets. Within the UK, climate-related financial disclosure regulations have become mandatory for some companies and LLPs. Non-binding guidance[xvii] to help companies and LLPs better understand the requirements which include the entity’s governance in relation to managing climate-related risks and opportunities, climate risk identification, impacts, business model, and climate related KPIs.

US

The US is also making decisive ESG movements. In April, climate disclosures for publicly traded companies will be expected[xviii], aligning with the emissions scope 1-3 reporting standards but more worryingly fines are coming in fast for ESG in the US.

The regulators and customers already have the tools they need to catch firms out on sustainability disclosures. The US is showing firms that the ESG challenge is not hypothetical anymore, for the regulator or consumer.

Despite this, anti-ESG bills from a Republican majority House of Representatives may mean that full ESG regulation being fully implemented in the coming years may very well be decided by politics as much as market pressure.

At a federal level, the Senate rejected the DOL ESG Investing rule[xix], while the House Republicans expressed their disapproval of the rule. Several states are actively pursuing anti-ESG legislation including Georgia, Kentucky, Texas and Montana. However on the flip side, Oregon and Rhodesia Island have proposed legislations including Climate Risk Disclosures.

Ultimately, the divided opinion on ESG in the US may force banks to choose between red and blue states.

Asia

In Asian countries there has been a shift in focus to ESG. Most Asian countries have revised their climate targets and introduced Net Zero Commitments.

There has been movement towards a harmonised taxonomy[xx], similar to the EU taxonomy regulation, to attempt to standardise the sudden increase in ESG taxonomies and regulations. The ASEAN taxonomy is highly reminiscent of the EU Taxonomy, however it allows for higher emissions over a limited time “while incentivising progression to lower emissions”.

China has introduced six sectors to its bond system[xxi] that it classifies as green: clean energy, clean transport, climate change adaptation, recycling or resource conservation, anti-pollution, and energy efficiency.

Malaysia and Japan have adopted systems based on the Green Bond Principles[xxii], and Mongolia, the only Asian country so far to do so, has incorporated a social element into its taxonomy. However, like much of the ESG conversation globally, the focus is primarily environmental.

Reading the key elects of ESG globally might lead you to ask, but what about the S? The second leg of ESG is certainly lagging behind, often pointed to as part of the UN’s high level Sustainable Development Goals, such as 10) Reduced Inequalities and 8) Decent Work.

These regulations are moving forward at a much slower pace, looking at issues including diversity, bribery, labour standards, freedom of association, corruption and corporate governance. The biggest driver here will be commercial as investors show more consideration for Social and Governance elements, resulting in real, tangible impacts on risks and returns. This is not just a market driver though, as regulators are looking at the UN SDGs, COVID has introduced new importance in targeting social inequality, it will likely not be long before regulators turn more targeted attention to the remainder of ESG and the more complex data challenges it presents.

Regardless, the spotlight is fixed on the ESG marathon for 2023, requiring enormous amounts of new data across not only firms, but their supply chains. ESG radars are unlikely to quiet down any time soon as data demands gain momentum globally. Firms must enact carefully laid plans if they want the shiny medal at the finish line of being seen to be ESG-compliant, and not to be caught out with fines and profit loss as a straggler at the end.

[i] https://www.researchgate.net/publication/228273506_Does_it_Pay_to_Be_GoodAnd_Does_it_Matter_A_Meta-Analysis_of_the_Relationship_between_Corporate_Social_and_Financial_Performance

[ii] https://journals.sagepub.com/doi/abs/10.1177/0007650315584317

[iii] https://www.esma.europa.eu/sites/default/files/library/sustainable_finance_-_implementation_timeline.pdf

[iv] https://www.ifrs.org/news-and-events/news/2022/12/issb-announces-guidance-and-reliefs-to-support-scope-3-ghg-emiss/

[v] https://www.bis.org/bcbs/publ/d532.htm

[vi] https://sdgs.un.org/goals

[vii] https://sdgs.un.org/goals/goal13

[viii] https://www.ifrs.org/projects/work-plan/climate-related-disclosures/

[ix] https://finance.ec.europa.eu/sustainable-finance/tools-and-standards/eu-taxonomy-sustainable-activities_en#:~:text=The%20Taxonomy%20RegulationEN&text=was%20published%20in%20the%20Official,to%20qualify%20as%20environmentally%20sustainable.

[x] https://www.esma.europa.eu/sites/default/files/library/esma50-165-2329_trv_trv_article_-_eu_ecolabel_calibrating_green_criteria_for_retail_funds.pdf

[xi] https://www.esma.europa.eu/sites/default/files/library/sustainable_finance_-_implementation_timeline.pdf

[xii] https://www.esma.europa.eu/press-news/esma-news/esas-provide-clarifications-key-areas-rts-under-sfdr

[xiii] https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:32022L2464

[xiv]https://www.bgbl.de/xaver/bgbl/start.xav?startbk=Bundesanzeiger_BGBl&jumpTo=bgbl121s2959.pdf#__bgbl__%2F%2F*%5B%40attr_id%3D%27bgbl121s2959.pdf%27%5D__1680086820093

[xv] https://www.amf-france.org/en/news-publications/news-releases/amf-news-releases/sustainable-finance-disclosure-regulation-amf-proposes-targeted-review-include-minimum-environmental

[xvi] https://www.gov.uk/government/publications/uk-joint-regulator-and-government-tcfd-taskforce-interim-report-and-roadmap

[xvii] https://www.gov.uk/government/publications/climate-related-financial-disclosures-for-companies-and-limited-liability-partnerships-llps

[xviii] https://www.sec.gov/sec-response-climate-and-esg-risks-and-opportunities

[xix] https://www.congress.gov/bill/118th-congress/house-joint-resolution/30

[xx] https://asean.org/book/asean-taxonomy-for-sustainable-finance/

[xxi] https://www.climatebonds.net/files/reports/cbi_china_sotm_2021_06c_final_0.pdf

[xxii] https://www.adb.org/sites/default/files/publication/838756/green-bond-market-survey-malaysia.pdf

[ii] https://finance.ec.europa.eu/capital-markets-union-and-financial-markets/company-reporting-and-auditing/company-reporting/corporate-sustainability-reporting_en

[iii] https://www.fca.org.uk/publication/correspondence/dear-ceo-letter-esg-benchmarks-review.pdf

[iv] https://finance.ec.europa.eu/capital-markets-union-and-financial-markets/company-reporting-and-auditing/company-reporting/corporate-sustainability-reporting_en