With newly minted FS reporting strategies, the EU and UK are focused on enabling the fasteners of digital finance. This article summarizes the 2022 transformation drivers for public and private sectors, and how you can get involved in DRR.

2022 transparency drivers

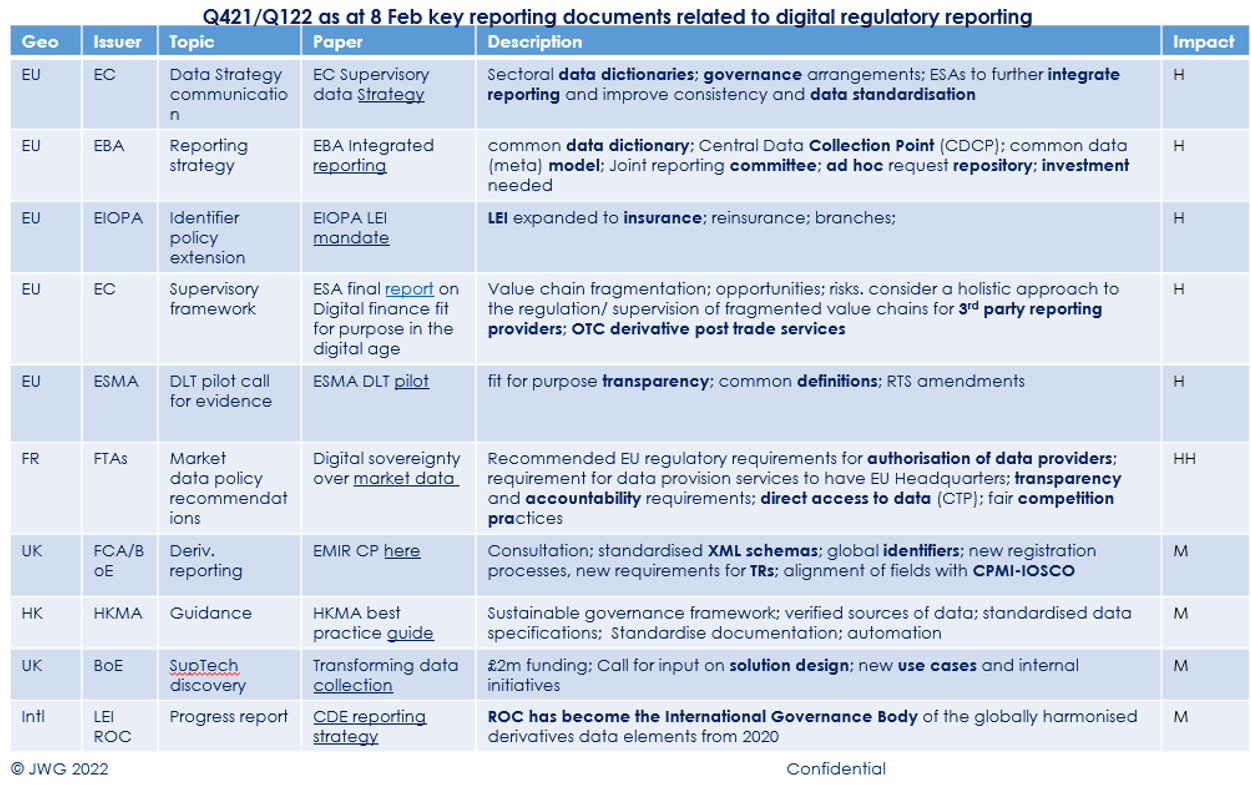

As we discussed in our 2022 Outlook, digital assets are coming into the light as regulatory reporting obligations bring them into scope. From December 21 – February JWG analysed over 2800 regulatory documents discussing data and picked out the key strategic discussions for review by the special interest group (Exhibit 1 below).

Exhibit 1: JWG analysis of key regulatory reporting

While this list is by no means complete, it shows where the digital spikes and sleepers need to be laid. New governance, identifiers, digital controls, standard, messages and schemas are all part of the discussion this year.

The drive to share more information between the private and public sectors provides a much-needed push to large firms as they shifting to model-driven controls to oversee tens of thousands of risk control assessments.

A year ago, JWG called 2021 the tipping point for DRR and we think this prediction will hold true. RegTech leaders have the opportunity this year to help drive the linkage between data controls and risk by using semantics to align real-world and supervisory information needs via industry-standard models (e.g., CDM).

The Digital Reporting Task force

As we wrote when we launched the task force in July, Tomorrow’s regulatory dashboard needs to be driven by public-private collaboration and support the objective of a real-time radar for the whole financial system. We have been pleased with the level of engagement between supervisors, academia, firms and leaders in the digital supply chain and enthusiasm to discuss viable solutions.

The 5th meeting of the Digital Reporting Taskforce was held on February 8, 2022. The group of public and private sector SMEs discussed a list of SupTech/RegTech problem statements and dove into the problem of data definition and the alternatives available for storing and managing a network of contracts.

The group shared the concerns voiced in the most recent regulatory documents about the need for data dictionaries and common definitions when looking at the meaning of structured data. We also explored the appropriate technology design for capturing the information. Stay tuned for more on our conclusions shortly.

Strategic implications

The addition of a ‘digital rail’ for finance will not neatly align with the existing rails by itself. For it to be of the same safety standards and interoperable with TradFi tracks, Digital Assets need to rely on a shared application of RegTech.

The great news is that TradFi rails are being retooled, and new ones added (e.g., ESG) we are hitting the refresh cycle for Basel IV, MiFID II, EMIR and Dodd-Frank. The implementation work we are doing in the next 3 years can define the next generation of plates.

To get there, however, leadership is required to step up out of comfortable mandates to recognise that if each actor stays in their lane and market forces will continue to drive a piecemeal approach to RegTech business cases.

JWG believes that the FS sector is incapable of manging this digital transformation to better, faster, cheaper and safer digital rails, without a plan which involves financial institutions, regulators and the infrastructure that serves them.

This means that the ‘Tech’, ‘Data’ and ‘Controls’ tribes need to join forces and align perspectives and tools so that all risk perspectives are included in this next wave of digital regulation.

As we learnt in our 6th Annual RegTech conference, 5-year Investment plans are a thing of the past. However, this doesn’t mean transformation plans can’t be built off work required for pressing new regulatory requirements.

Perhaps the key for 2022 is selling the speed and quality of the ride on the new rails, not how great it is to engineer a digital track.

Special interest groups

Back in 2017, as we finished running over 100 meetings for the MiFID II Implementation Group, we decided to harness the insight we gained about front office pain points to explore what new technology could do to alleviate middle and back-office regulatory challenges.

5 years later, we have run dozens of special interest groups with hundreds of subject matter experts from scores of firms, regulators and their trusted suppliers.

Over the past three years we have focused on taking RegTech out of the laboratory and onto the battlefield of new regulatory implementation programmes like JWG’s Derivatives Digital Regulatory Reporting programme (DRR).

In parallel we worked with regulators and regulated to explore the digitalization of risk data collection via our Regulatory Reporting group.

Both efforts led us to look at the deployment of industry-led common domain models which will be the cornerstone of NextGen SupTech reporting efforts.

The materials for the sixth task force meeting on 22 March can be found here and the materials from the past 5 years of the regulatory reporting SIG can be found here.

For more information on membership contact Corrina.Stokes@jwg-it.eu