The regulatory spotlight on stablecoins has intensified this month with the Financial Stability Board (FSB) Crypto-asset paper noting[1] that many existing stablecoins still would not meet their recommendations.

International risk management principles will be welcomed, but 2023 will be the year that the industry needs to define a better approach to managing compliance in a digitally-native manner. JWG have pioneered RegTech tooling which gives enterprises the power to scan the horizon and configure their obligations into a single business truth.

In preparation for our annual virtual conference on 9-10 November we have reviewed the approach to stablecoins. Please join us for the debate!

FSB update

The Financial Stability Board are consulting on a proposed approach for establishing a comprehensive regulatory framework which they hope to have in place by Q223.

In their 10 high-level recommendations[2] to address international and domestic financial stability risks the FSB recognises that international clarity on the framework is necessary to enable jurisdictions to implement domestic approaches.

The FSB is concentrating on the following areas:

- Governance

- Risk management with regard to consumer protection, market integrity, operational resilience, cyber security and AML/CFT

- Data protection

- Recovery and resolution planning

- Stablecoin issuance, transfer, distribution, and redemption

- Cross-border and cross-sector cooperation and coordination for global stablecoin arrangements

Across all themes, the recommendations call for flexibility, consistency, coordination, and information-sharing between jurisdictions to keep up with the changing nature of the risks posed by global stablecoins.

Stablecoin Background

Even before crash of Terra-USD stablecoins have been on the radars of policy makers, traders and general public.

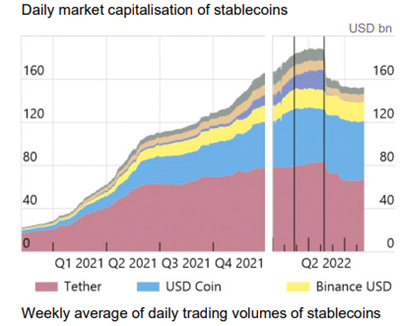

Since its inception in 2014, stablecoins have grown rapidly to a market cap[3] of 148 billion, 40 billion are being traded daily and 2 spots on top 5 crypto currencies (by capitalisation) are currently occupied by stablecoins.

Sources: CoinGecko; CryptoCompare; Tether; FSB calculations, October 2022 here

The asset’s popularity is primarily due to an ability to have a stable value which is usually achieved through a peg against fiat currency on a 1:1 basis. Stablecoins have been seen as a tool for financial inclusion[4] and financial stability, with many people now using them as a payment medium through leading private companies like Tether who controls nearly 50% of the stablecoin market with its USDT coin.

Stablecoins are still not widely used and before they become systemically important and fit for use across jurisdictions, authorities need to be ready to regulate. As we covered in our previous digital assets article[5], Tether was fined $41 million for falsely claiming it was fully backed by US dollars.

United States (US)

In the United States, stablecoin debates picked up pace with the US House Committee on Financial Services on February 8th, 2022 holding a hearing[6] where they discussed the President’s Working Group (PWG) on Financial Markets’ Report on Stablecoins[7] that was released Q4 2021. The PWG identified regulatory gaps in using stablecoins as investments or payments. They highlighted three risks associated by stablecoin use: 1) run risk 2) payment system risk and 3) systemic risks and economic concentration of power.

The US doesn’t have a unified approach to its treatment of stable coins and draft Stablecoin Innovation and Protection Act of 2022[8] and Stablecoin TRUST Act of 2022[9] Congress and Senate discussion documents were released following the hearings.

The drafts define “payment stablecoins” as a convertible virtual currency that is designed to maintain a stable value relative to a fiat currency or currencies; is convertible directly to fiat currency by the issuer; is designed to be widely used as a medium of exchange; is issued by a centralized entity and does not inherently pay interest to the holder. On June 7th, the Responsible Financial Innovation Act[10] (RFIA) was introduced by US Senators Cynthia Lummis and Kirsten Gillibrand to define terminology like “ancillary assets,” “stablecoins” (which also includes a proposal to establish reserve requirements for stablecoins), and “virtual currencies” that are frequently used in the context of digital assets.

The Howey test is also used in the act to determine which digital asset qualifies as a “security” or a “commodity.” This distinction makes it easier to determine which regulatory authority will oversee the digital asset. The Commodity Futures Trading Commission (the “CFTC”) regulates commodities in the United States, while the U.S. Securities and Exchange Commission regulates securities (the “SEC”).

European Union (EU)

EUROC, a stablecoin for Europe that is Euro-pegged and 100% backed by the Euro was launched by Circle on 30th June, the same day as the EU announced[11] that an agreement was reached on European crypto-assets regulation (MiCA). The EU Council published the approved text[12] on 10th October, documenting important rules for Crypto Asset Service Providers (CASPs).

According to the document, the MiCA framework limits non-euro stablecoins to transaction volume of 1 million transactions and 200 million Euros per day in the EU. MiCA also requires the European Banking Authority (EBA) to maintain a record of non-compliant crypto asset service providers.

Stablecoin issuers are required to maintain ample reserves, with a 1/1 ratio (one stablecoin can be exchanged with one unit of currency) or partly in the form of deposits, to meet redemption requests in the event of mass withdrawals fully protecting consumers in case of insolvency.

United Kingdom (UK)

Stablecoins that are fiat-referenced and used as a means of payment are governed under the UK’s Financial Services and Markets Bill[13] (FSMB), published on July 20. The bill’s approach, described in its explanatory note[14] is consistent with both the CPMI-IOSCO consultation study on the application of the Principles for Financial Market Infrastructures to stablecoin arrangements and the Financial Stability Board’s recommendations on the regulation, oversight, and management of international stablecoin arrangements.

The Bill seeks to amend the Banking Act of 2009 and the Financial Services (Banking Reform) Act of 2013 to now refer to stablecoins as “digital settlement assets (DSAs)”, in the section on digital assets. Additionally, it would give the Treasury permission to exert its authority over DSAs, DSA service providers, payments made with DSAs, and DSA insolvency agreements.

Australia

The Digital Assets (Market Regulation) Bill 2022[15] is in consultation until 31st October 2022. The bill seeks to set a regulatory framework for digital assets by proposing licensing requirements for persons issuing stablecoin in Australia.

It proposes that Stablecoin issuers should hold the full amount of the face value in reserve via an Authorized Deposit taking Institution (ADI) and quarterly statements of these values must be sent to APRA. The Australian Treasury is yet to release their public consultation paper on “Token Mapping” according to a media release[16] from the ministers. Token mapping approach that is unique to Australia will help identify how crypto assets and related services should be regulated.

Japan

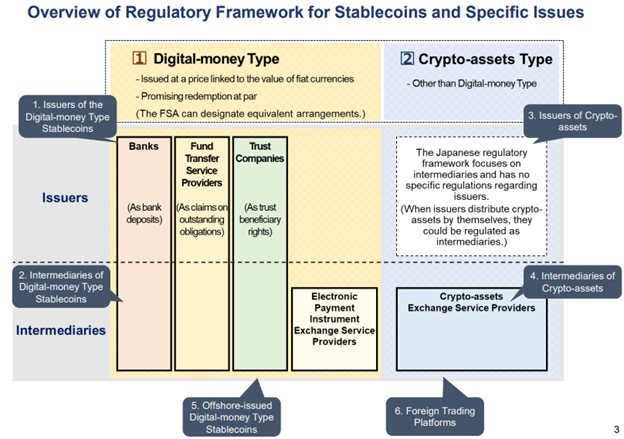

In a report[17] by the Financial Services Agency of the Japanese Government, a regulatory framework has been designed for fiat-linked stablecoins that is expected to enter into force by June 2023.

The law’s new provisions on stablecoins restrict non-algorithmic stablecoins stablecoin issuers to banks and licensed money transfer companies that have asset custody capabilities and trust companies. A new licensing system is in the works to register other stablecoin issuers and brokers.

Source: Japanese Financial Services Authority, September 2022 here

Singapore

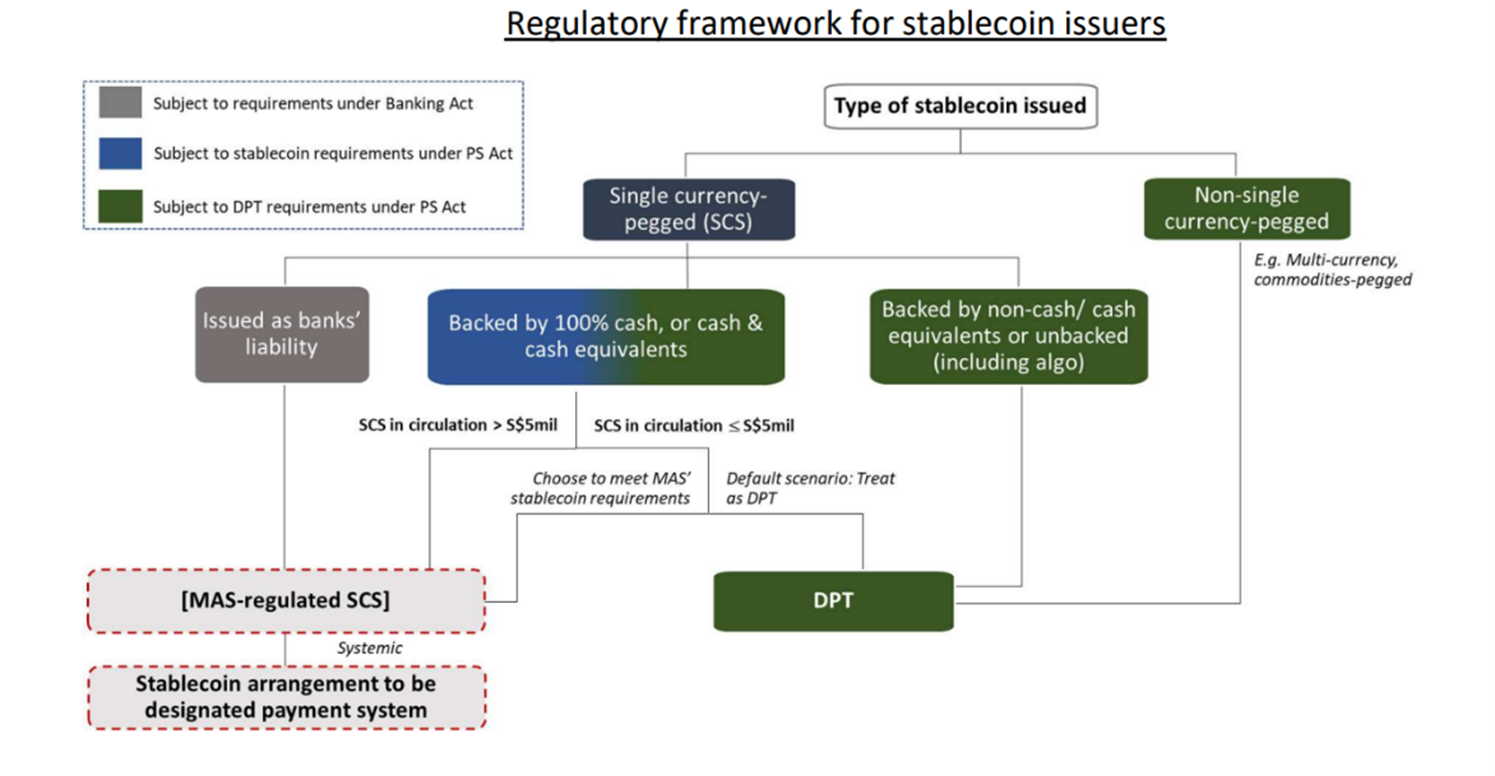

Singapore has also made advances in their regulatory approach to stablecoins as they plan to expand their current regulatory framework to ensure that regulated stablecoins have a high degree of value stability.

To support the development of stablecoins as a credible medium of exchange in the digital asset ecosystem Monetary Authority of Singapore has published a consultation paper on regulatory approach for stablecoin-related activities.

Source: Monetary Authority of Singapore, October 2022 here

One of the main changes concerns issuance of stablecoins that are pegged to a single currency (“SCS”), SCS can be issued by non-bank entities and banks and if their value exceeds S$5 million in circulation, they will now be regulated by MAS.

Other key proposed issuer requirements relate to:

- Value stability

- Reference currency

- Disclosures

- Prudential standards.

Stablecoin conclusion

Stablecoin regimes are adopting slightly different approaches to classifying this asset class and the risk measures which are required for firms to be able to use them.

Local regimes will build on existing consumer protection law to bring stablecoins within their respective regulatory perimeter. In general, they appear to have two things in common.

The first is the that stablecoin issuance will be limited to insured depositories or banks.

The second is that they need to either require 100% backing by sovereign securities or require 100% backing by central bank reserves.

This will make global oversight of them challenging as risk-based approaches will need to account for slightly different regulatory obligations by jurisdiction.

As we identified in Q1 in our article on the rise of digitally-native compliance, It may seem obvious, but digital assets need digitally native compliance.

This means that compliance policies needs to be embedded in the asset to enforce the controls.

The role of RegTech

JWG has pioneered RegTech tooling which gives enterprises the power to scan the horizon and configure your obligations into a single business truth.

Unlike any other provider, we use NLP to determine relevance from millions of alerts, enrich every document with a deep, proprietary model for FS obligations and deliver them to your instance in near-time as global policy develops.

2023 will be about what industry protocols and standards are required to enable the intersection between TradFi and Digital Asset rails.

For digital assets, this means that a very high barrier for entry to the markets just got a lot lower. See our analysis on how RegTech helps enable clean controls here.

For more information on how we can help with RegDelta and our RegRadar services see here.

Experts look forward to expanding on their insight about how digital asset firms can leverage RegTech for digitally-native compliance at our annual conference on 9-10 November. Please join us!

Please contact Corrina.Stokes@jwg-it.eu if you would like more information.